Money Talk financial literacy conference focuses on wealth building

Entrepreneurs make connections at event

The vast wealth gap between whites and blacks in Boston — $247,500 to nearly zero — has become a widely cited statistic since the Federal Reserve Bank of Boston, in conjunction with Duke University and The New School released its “Color of Wealth in Boston report in March 2015.

Author: Photo: Lolita ParkerTerri Williams leads a discussion during the Banner’s Money Talk Financial Literacy Conference.

On the web

“The Color of Wealth in Boston” (March 2015): https://www.bostonfed.org/publications/one-time-pubs/color-of-wealth.aspx

“Packaged Facts: African American Buying Power Tops $1 Trillion,” Sept. 26, 2016: http://www.prnewswire.com/news-releases/packaged-facts-african-american-buying-power-tops-1-trillion-300332139.html

“Cities Building Community Wealth,” The Democracy Collaborative, Nov. 2015: http://democracycollaborative.org/cities

U.S. Social Investment Forum, “Report on U.S. Sustainable, Responsible and Impact Investing Trends, 2014”: http://www.ussif.org/Files/Publications/SIF_Trends_14.F.ES.pdf

“SRI Basics”: http://www.ussif.org/sribasics

Last weekend, a collection of business leaders, financial professionals, activists and entrepreneurs set about the work of closing that gap during the Banner’s financial literacy conference on, “Money Talk: Building Black Wealth,” held at the Reggie Lewis Track and Athletic Center, an event partner. Other partners included Roxbury Community College, Epicenter Community and NAACP Boston.

While much of the conference focused on financial literacy and the accumulation of personal and business wealth — with tracks including personal finance, entrepreneurship and home buying — the overarching theme of building community wealth formed a backdrop to the day.

OneUnited Bank President Teri Williams kicked off the opening discussion asking panelists to define the meaning of community wealth.

“Community wealth is a way of organizing the economy so that it benefits everybody instead of the way it is now, which is an economy that benefits the few,” said Marjorie Kelly, Senior Fellow and Executive Vice President of The Democracy Collaborative during the opening panel discussion.

Kelly is a journalist and noted author on business ethics and inclusive ownership whose organization works on community economic development via a variety of models, including procurement strategies, employee stock ownership plans (ESOPS), worker cooperatives, nonprofit social enterprise and land trusts. At the Money Talk event, she described how persuading large “anchor institutions” such as hospitals and universities in Cleveland, Ohio to invest, hire and buy goods and services locally helped boost the city’s struggling economy by creating jobs and business opportunities. The goal: keep money circulating locally.

Glynn Lloyd, newly-appointed executive director of Eastern Bank’s Minority Business Enterprise Initiative, who is an expert on investing for social impact, said that while wealth is typically thought of as the accumulation of cash, property and other assets, social capital — having friends and acquaintances who can open doors to opportunities — also is an important part of wealth accumulation.

“We struggle with how we’re going to get ours and how we’re going to get ahead,” he said. “We also need more discussion about how to build community wealth.”

Author: Photo: Lolita ParkerBusiness owners had opportunities to broaden their networks, meeting entrepreneurs from diverse backgrounds.

Cultivating wealth

Lloyd said the current state of the U.S. economy, in which wealth is concentrated in the hands of the few, isn’t good for our democratic society.

“Concentrated wealth breeds fragility,” he said.

Banner Editor and Publisher Melvin B. Miller suggested that the communal aspect of wealth building should be centered in the culture of a community — the way children are reared, keeping streets clean, and not spending wastefully on throwaway items.

“We can relate the underpinnings on which wealth can accumulate,” he said.

Williams cited one tool for building community wealth and asked the panelists whether “buy black” strategies work. The use of tools such selective purchasing and boycotts to achieve equity were honed throughout the 1950s, ’60s and ’70s during the Civil Rights Movement and discussions of South Africa-related business activity in the 1980s.

Lloyd noted that African Americans have substantial buying power with $1.3 trillion in annual spending.

“We all have the power,” he said. “How we spend our money is important.”

Miller suggested that in addition to buying black, African Americans should be judicious in their spending.

“We have to start off by thinking about what we’re buying with,” he said. “The reason we’re having this conference is so that we can learn to handle our resources intelligently.”

In addition, Miller suggested that black savings and investment could be as formidable a power as black spending.

“We have to start putting together a plan about how to amass wealth a little bit at a time,”

he said.

During the breakout sessions, participants attended discussions including “How to create wealth using Roth IRA and mutual fund investments” and “If you love your family, save like it.” An entrepreneurship track included sessions such as “How can your tax dollars help your business?” and “The top ten legal mistakes made by entrepreneurs.”

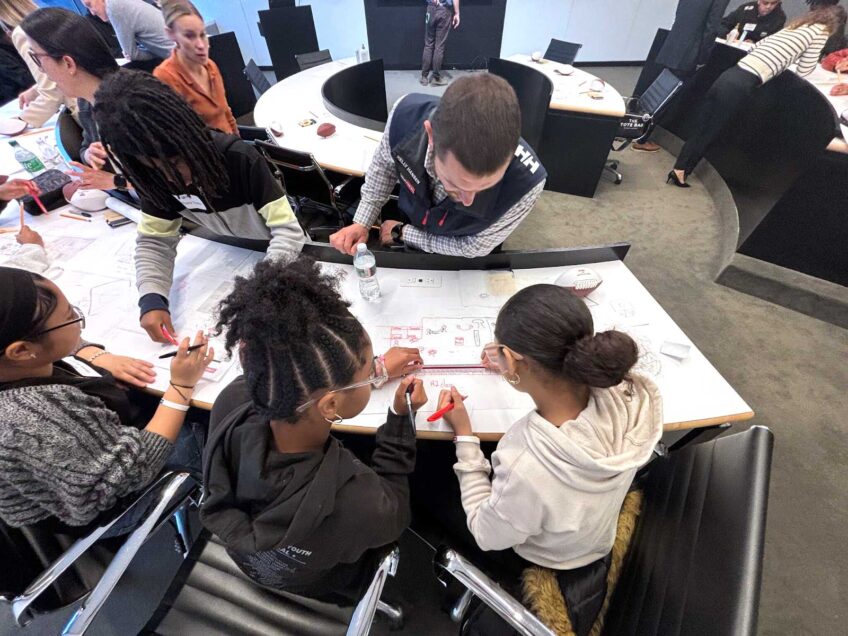

Author: Photo: Lolita ParkerParticipants in the conference attended workshops on topics including personal finance and entrepreneurship.

Sharing resources

During the opening session of the entrepreneurial track, Epicenter Community President Malia Lazu encouraged participants to share their business goals and ideas, then facilitated a networking session.

Among the attendees: a real estate broker looking to expand into investment, an entrepreneur looking to scale up her embroidery business, an accountant looking to expand a line of work helping blacks manage wealth.

“As you build wealth, we want you to maintain it,” said Erica Rose of EMD Shared Services America.

Most of the people attending were African American. As Lazu noted, the lack of family wealth in the black community can be a disadvantage, but through networking with like-minded individuals, black entrepreneurs can better share know-how and resources.

“We don’t have so much friends and family capital,” she said. “We need to find another way. Talk to each other. ‘This is what I have’ and ‘This is what I need.’”

Sponsors of Money Talk included OneUnited Bank, Eastern Bank, Zevin Asset Management, Boston Common Asset Management and Lurie Davis Wealth Management. The Money Talk gathering is the first in a series of structured conversations about building individual, family and community wealth while advancing an inclusive, sustainable economy.

Marcy Murninghan contributed to this article.