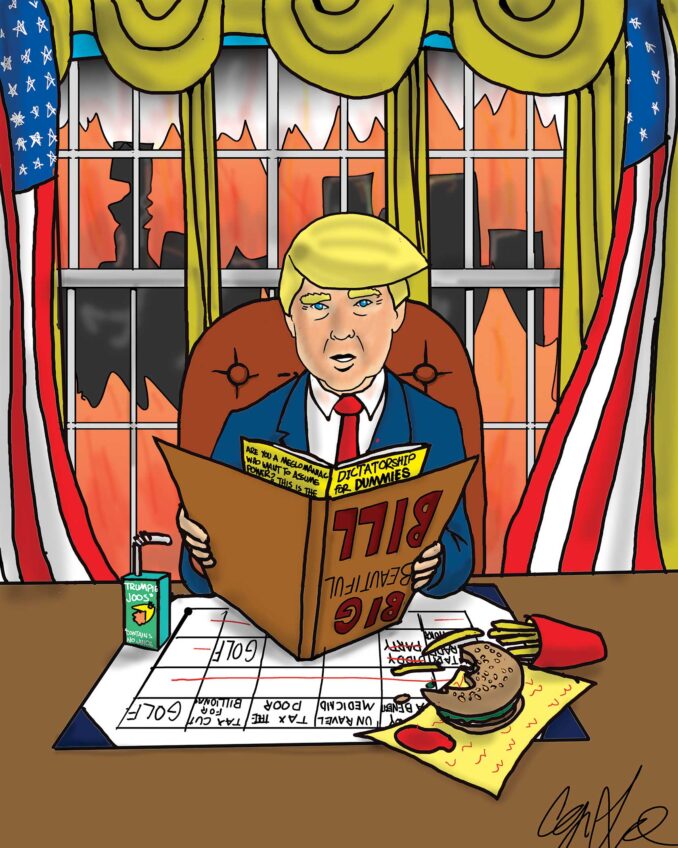

Economic equality at risk

African Americans are now in the most challenging phase of their quest for full equality. The battle for civil rights was indeed the most dangerous. Many citizens had to put their lives on the line in order to end rank racial discrimination and to demand the right to vote. However, the present phase — economic equality — is just as deadly, even if considerably more subtle.

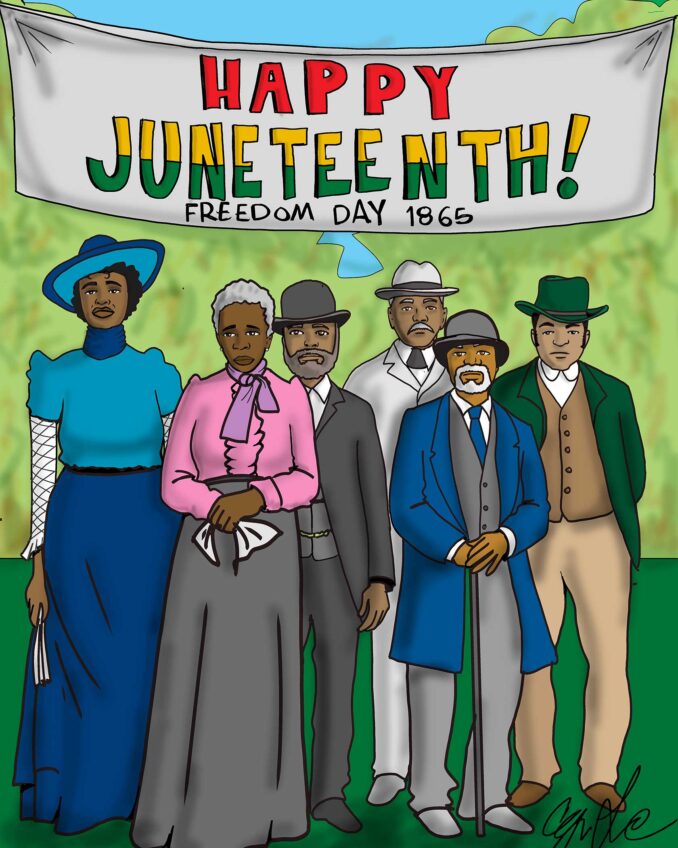

The ultimate objective of America’s oppression during slavery and the Jim Crow era was primarily to provide economic dominion to the business titans. The marginalization of the oppressed was necessary to justify the inhumane conduct of the ruling class. Christian doctrine requires that we become our brothers’ keepers. It was necessary, therefore, to categorize slaves as “the others” in order to eliminate any familial obligations.

While there has been substantial advancement on the civil rights front, economic progress has been lagging. The unemployment rate for blacks is roughly twice that of whites. Family income for blacks in 2009 was only $38,409 compared with $62,545 for whites. And the wealth gap between blacks and whites is lopsided. According to a study by the Pew Research Center, the median net worth of white households in 2009 was $113,149 compared with only $5,677 for blacks.

The growth in black business has provided some encouragement. According to U.S. Census data, in the five years between 2002 and 2007 the number of black-owned businesses increased by 60.5 percent to 1.9 million. Their total sales increased to $137 billion. While that might seem to be a substantial volume, it is quite small when compared with the size of major U.S. companies. Only one company — Walmart — had sales in 2010 that were more than three times larger than the combined sales of all black-owned businesses in 2007.

Progress in farming has also diminished. That is a business blacks in the South know well. However, the number of black farms has declined from 900,000 in the 1920s to only 43,000 in the last census. The past refusal of the U.S. Department of Agriculture to make or guarantee loans to black farmers has caused many of them to lose their homes and their land.

The employment of some well educated and talented blacks in jobs with big salaries in the executive suite has created the illusion that economic equality is approaching. In fact, the recession has caused a 53 percent decline for blacks in their median net worth from 2005 to 2009. More than a third of black families (35 percent) had negative net worth in 2009.

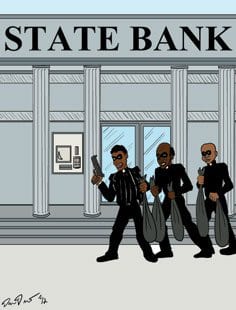

Clearly, the financial status of African Americans must improve or every other achievement is for naught. Critical to the economic advancement of African Americans is the expansion of the role of black-owned banks. Black banks must become strong enough to lead the way to black wealth.

Visionaries established the first black-owned banks in 1888. Today only 50 minority-owned banks belong to the National Bankers Association, a trade group that also includes Asian and Hispanic banks. OneUnited Bank is the largest black-owned bank in the U.S. Like other black banks, OneUnited is the bank of last resort for many minority home owners and entrepreneurs who have been rejected by major banks, often because of their racially discriminatory policies.

Black banks assume substantial risk by lending to minority communities that are often financially endangered. Most borrowers understand that the consequences of default can be quite severe. However, the lawyers for Charles Street church have fashioned a defense that creates an untenable position for banks. Lenders would be required to predict accurately the successful outcome of the borrower’s project or be penalized. The bank would have to forfeit the amount of the loan.

If such a rule gains acceptance in Massachusetts and elsewhere, it will impose a risk that no well managed bank can assume. How ironic that the black church, so prominent in the civil rights movement, will essentially end the role of black banks in the drive for economic equality.