Every year Medicare offers a period of open enrollment to allow participants to join, switch or drop a plan. Medicare is a bit complex, however, so you have to know its A, B and C’s.

Medicare was established under President Johnson’s administration in 1965 as an amendment to the Social Security program. Its overall purpose is to help pay for the medically necessary health care of the elderly population.

The cost of the program has burgeoned over the years for a number of reasons. The average life expectancy increased from 68 years in 1965 to 76 years in 2021. In addition, more people became eligible. In 1972, regardless of age, Medicare was expanded to cover certain disabled people and those with end-stage renal disease requiring dialysis or kidney transplant.

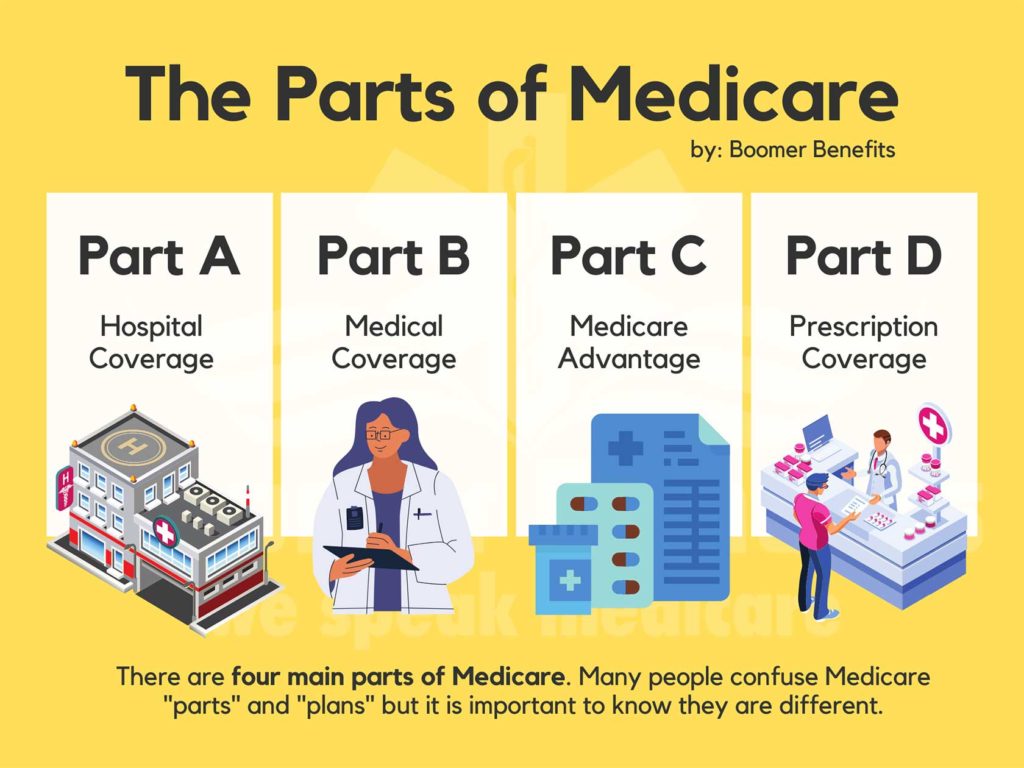

It increased from Parts A and B, referred to as the original Medicare, to include Parts C, a managed care component and D, a drug plan.

Part A pays for in-patient care in hospitals and skilled nursing facilities as well as home health and hospice care. If a person has paid 40 quarters, or ten years, into the Social Security program, there is no premium for Part A. For those who do not meet these qualifications − recent immigrants, for example − the monthly premium in 2024 can exceed $500 .

Part B, on the other hand, helps cover treatment by physicians, outpatient care, tests and preventive services, such as screenings and immunizations. There is a premium for Part B based on income. The minimum premium in 2024 is $174.70 but rises to $594 for individuals with an income of $500,000 or more.

Both A and B have advantages and disadvantages. One attraction is freedom of choice. In most cases you can go to any health provider or hospital that accepts Medicare. A referral is not necessary as long as the specialist is enrolled in Medicare and accepting new patients.

But there’s a catch to this freedom. Both parts have deductibles and coinsurance that can add up when extensive medical care is required. For instance, in 2024, there is a deductible of $1,632 for a hospital stay. Another drawback is that, for the most part, out-patient drugs are not covered.

That’s a problem right there. According to Health United States, 2019, 89 percent of people 65 and older took at least one prescription drug, and 42% report taking four or more prescription drugs.

That’s where Part D comes in – a drug program for those who choose the original Medicare. If a person has creditable prescription drug coverage through an employer or union, for example, it is not necessary to purchase a separate drug plan. However, prescription coverage is not an option. A lapse of coverage for 63 or more days in a row may result in penalties that could apply permanently.

There’s another alternative, though. Medicare Advantage plans, or Part C, are network-based, such as a health maintenance organization or preferred provider organization. Most include drug coverage.

These plans, however, remove freedom of choice. You are confined to a particular network. If that doesn’t work for you, perhaps a Medicare Supplement Insurance will. Known as Medigap policies, these supplement Original Medicare benefits and help pay for some of the out-of-pocket costs not covered, such as deductibles and coinsurance. They do not cover drugs, however, so a separate drug plan is required.

The open enrollment period extends from October 15 to December 7. The plan chosen begins in January. Choose wisely. For the most part, that decision remains in effect until the following January. If you need a little help, visit medicare.gov. Based on your zip code and preference, an overview of different plans in your area is offered. Free counseling is also available through SHINE (Serving the Health Insurance Needs of Everyone) at 1-800-243-4636. Beware of mailings and TV ads that often present deceptive marketing.

Keep it simple and view it by the alphabet. You have three options: A, B, and D or A, B, Medigap, and D, or A, B, and C. It’s complicated, but if you keep your letters straight, it should work out.