When slavery was prevalent and permissible in the South, the lowly status of Blacks was well known. Affluent whites unleashed America’s big con after the Civil War. After pointing out the destitute conditions of Blacks who had just been released from slavery, white landowners asserted that all whites were brothers and were superior to Blacks, who were their enemies although indigent.

Many states in the Antebellum South had majority Black populations, so the first task was to keep Blacks away from the voting booths. But just as important was the need to keep whites who were of the lowest social class from joining with Blacks to establish a united front to improve the economic condition of all those who were suffering from poverty.

Somehow, impoverished whites were made to believe that Blacks were their enemy. Rather than joining with Blacks who were deprived as much as they, poor whites joined with well-to-do-whites, who succeeded in making the recently freed slaves appear to be a primary source of difficulty for whites.

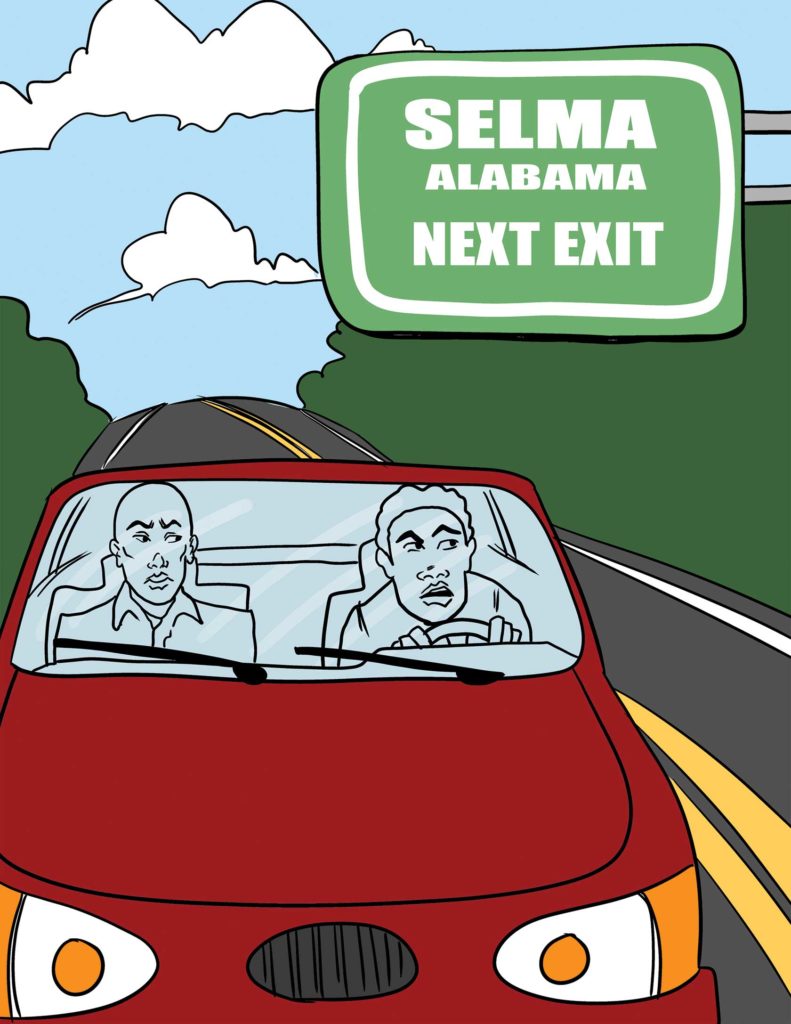

A recent report in the New York Times indicates how the criminal justice system in Alabama was designed to entrap the poor by imposing revenue-generating fees on the impoverished, regardless of whether they are white or Black. According to the report, those who owned substantial estates in Alabama’s productive land areas and wealthy businessmen colluded over a century ago to prevent development of the state to benefit lower income residents.

The strategy was to rewrite the state’s constitution to cap taxes permanently. As a consequence, tax revenues cannot be raised to pay for customary expenses such as schools, public transportation and appropriate health care. Property taxes, a major source of governmental revenue, are inadequate to meet the normal needs of society. According to the report, only 7% of state municipal revenue came from property taxes in 2019. By comparison with other states, Mississippi got 12% and New Jersey got 29% from property taxes.

Alabama makes up the revenue shortfall by a complex system of fees and penalties paid by citizens. The criminal justice system provides a good source of revenue. Every time someone has to go to court or is stopped by the police for a mild or questionable driving infraction, the perpetrator pays a fine.

The report indicates that in 1874, the former slave-owning class rigged an election to pass a new constitution that mandated permanently low taxes on property. In the next couple of decades, poor sharecroppers, both white and Black, united to unseat the wealthy elites. But the elites called another constitutional convention to strengthen their position.

Unlike any other state, Alabama has a constitution that prevents the assessment of taxes by anyone without a constitutional amendment. The process for accomplishing that is so complex that changes in the state constitution are unlikely.

Conservatives in Alabama have thus devised a new approach to preventing social change. Innovation usually requires new funding. If the only way to finance a new project is to defund an existing one, that minimizes the opportunity to generate public support for change.

Liberals already analyze redistricting plans for states to establish that party representation is fair. Liberals must also examine the political structure of states to determine whether states, like Alabama, have developed systems to defy the democratic opportunity for change.