Banner Business Sponsored by The Boston Foundation

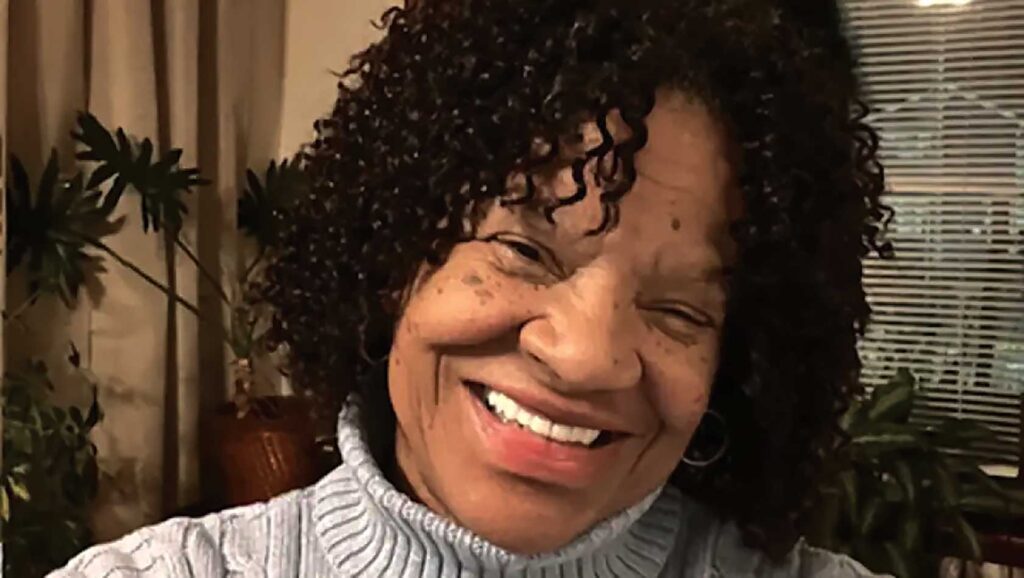

“I almost died when I opened that envelope,” said Sherry Peterson of Mattapan. Her quarterly bill increased by $500, or 40% more than she paid at the same time last year.

Peterson, 76, bought her two-family home in 1977 and shares it with her daughter’s family. She doesn’t want to sell their home, but she said the tax increase will cause significant strain on her fixed income. Peterson is retired and relies on social security to supplement her 401(k) and the rent her daughter pays for a share of the property.

“Massachusetts is not for seniors, I’ll tell you that. And not for the middle class or the poor,” she said. “Maybe if you’re rich, it’s a different story.”

Higher property tax bills are the result of several factors, including the shortage of housing, higher spending from local governments and updated property assessments.

Peterson’s home was assessed at $855,000, up from $785,000 the previous year. The assessor’s office attributed the increase to the sale price of similar two-family homes in the area. She said her house is the biggest on the block, but she has no driveway and no garage.

Homeowners who think they have been overcharged can apply for property tax abatements or exemptions at their local assessor’s office. The deadline to apply for an abatement is Feb. 3.

Peterson said she is considering her options to try and lower her tax burden.

Statewide, the average tax bill for a single-family home is $7,735, an increase of $336 from last year, according to Massachusetts Department of Revenue figures. But that tax burden varies greatly depending on location.

Adam Chapdelaine, executive director and CEO of the Massachusetts Municipal Association, said cities and towns are facing significant budget pressures due to factors like high construction costs, rising health care expenses and the need to match inflationary pressures in union contracts.

“Budget pressures and property taxes always go hand in glove,” Chapdelaine said.

He said local governments facing financial pressures must make hard decisions, especially if the choice is between reducing services or increasing taxes to meet those needs.

Some communities have chosen not to raise taxes to the full limit allowed under Proposition 2.5 in previous years but are now hiking bills to make up for that.

Another factor is how much commercial property tax comes into a city’s budget.

In Boston, the heart of the debate over taxes this past year was how remote work led to a decrease in commercial property values. Mayor Michelle Wu sought to address the tax issue by shifting more of the tax burden to the commercial side to avoid large residential tax increases.

Chapdelaine said it’s a delicate balance faced by many municipal leaders. “Any community could choose to tax commercial properties at the same rate as residential properties. But we see in communities that have a more significant commercial property footprint, they are legally allowed to tax the commercial base at a rate higher than the residential base,” he said.

Earl Smith, chair of the board of assessors in Watertown, said his city has been able to manage its budget without needing to override Proposition 2.5 or seek debt inclusions. He attributes that to both the financial discipline of city leaders and the revenue that Watertown receives from commercial properties.

“We’ve had Arsenal Yards, which is used to be the old Arsenal Mall, which as you know has been fabulously successful,” he said. “They built a hotel lab space, 300 apartments, a couple hundred thousand square feet of retail. They’ve hit it out of the park.”

Every five years, the Department of Revenue requires every city and town to do a complete reevaluation of all the properties within their bounds. His city is going through it now to make sure the tax system is done according to value.

“So if you’ve got a $1 million house, you’re paying twice as much as someone with $500,000 house,” he said. “The Department of Revenue wants to make sure everything is uniform.”

Massachusetts Secretary of State Bill Galvin said those who think they’ve been overcharged can apply for an abatement or a legal reduction in property tax bills if residents believe their property is overvalued compared to comparable properties. He said homeowners can go to their city or town’s website and look at assessed values of similarly situated homes.

“Particularly for people who feel that the assessment of their property is not accurate, it’s not as big,” Galvin said. “For instance, there aren’t five bedrooms, there’s only two. Or the description of the property might be wrong. Those are the strongest of abatement cases.”

Other reasons to seek an abatement include if the property owner is elderly or a veteran on a fixed income or is blind. Some towns also offer residential exclusions.

Galvin said he’s sympathetic to homeowners with limited incomes or who are struggling to pay a mortgage and now face higher tax bills on top of that.

When municipalities face these decisions, he said, “there were really no villains and there were very few heroes.”

Marilyn Schairer is a reporter and producer for GBH News.