Harris campaign’s key economic policies highlighted ahead of presidential election

Banner Business Sponsored by The Boston Foundation

As the nation prepares for Election Day on Nov. 5, the top issue of concern for Americans throughout all polls is no doubt the economy.

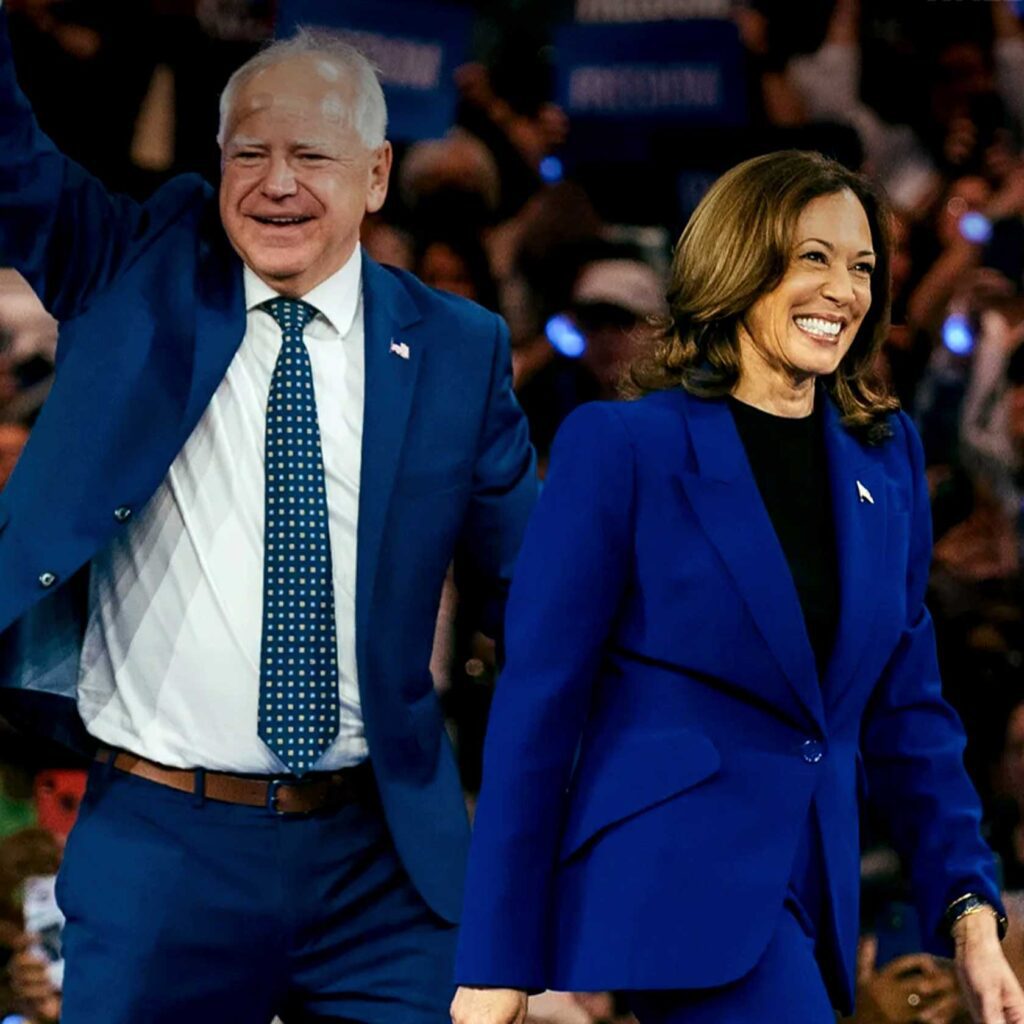

In her quest for the White House, Vice President Kamala Harris, the Democratic presidential nominee, has made several proposals aimed to build up America’s middle class.

She has proposed introducing more generous tax benefits for families, in turn hiking the corporate tax rate to help offset spending from bigger tax credits.

Harris also wants to permanently restore the Expanded Child Tax Credit to up to $3,600. Currently the mark for the 2023 tax year is $2,000 per child. For middle-class working families, the expanded Child Tax Credit lowered taxes or helped them pay their rent or mortgage, along with buying food, and essentials for their children.

Her plan also includes a Child Tax Credit of $6,000 for middle-income and low-income families for the first year of their child’s life. This would lower taxes or aid with the costs of formula, diapers, car seats and other costs.

The vice president’s proposal to expand the Child Tax Credit is projected to raise $4.1 trillion in taxes from 2025 to 2034. After accounting for tax cuts and credits, the net revenue would be around $1.7 trillion. However, factoring in slower economic growth, the increase in revenue would drop to $642 billion. The plan is also expected to reduce long-term GDP by 2%, lower capital investments by 3%, decrease wages by 1.2%, and result in 786,000 fewer full-time jobs, according to a report from the Northwest, D.C.-based Tax Foundation.

Meanwhile, Republican Senator JD Vance has suggested increasing the Child Tax Credit to $5,000 per child, though he admitted its “viability” would depend on Congress. Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, said he estimates Vance’s plan could cost between $2 trillion and $3 trillion over the same period, but the estimates may change as more details are released.

“The tax credits and other carve outs would complicate the tax code, run more spending through the IRS, and, together with various price controls, fail to improve affordability challenges in housing and other sectors,” Tax Foundation officials concluded.

For lower earning Americans without children, Harris is proposing an expansion of the Earned Income Tax Credit to help individuals who earn less than $63,398 (married filing jointly) or $56,838 (individual) in earned income with a $1,500 tax credit, almost tripling the current number.

The tax credits Harris is proposing could lift millions of children out of poverty and help with the cost of raising kids, but it could come with a price to pay.

To combat inflation that Americans saw peak at 9.1% in June 2022, the highest rate since 1981, Harris plans to call on Congress to pass the first-ever federal ban on price gouging.

The bill will set rules for big corporations to make sure they can’t unfairly increase prices on essential goods like groceries during times of crisis.

“Corporations should not be able to exploit times of crisis to excessively and indefensibly increase their profit margins at the expense of American families,” said Harris in her 82 page economic policy breakdown.

Harris also proposes to erase medical debt from the credit reports of Americans.

To provide access to more jobs to Americans that didn’t attend college, Harris is also proposing to eliminate four-year degree requirements for half a million federal jobs.

Keep in mind though, many of these acts would need to be agreed upon and voted through by the United States House and Senate before it can be put into action.

Harris and housing

Access to housing is a key component of Harris’s campaign; she wants to expand homeownership by increasing the supply of housing thus making it easier to obtain homeownership.

To achieve this goal she intends to push for the Neighborhood Homes Tax Credit, which would support the new construction or rehabilitation of over 400,000 owner-occupied homes in lower income communities.

This would provide significant tax relief for developers who build homes that are sold to working families that wouldn’t make their money back originally.

Along with that goal, Harris intends to call on Congress to pass the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, which aims to crack down on algorithmic systems used by landlords that contribute to surging rent prices by making those practices illegal under antitrust laws.

Harris is also calling on Congress to pass the Stop Predatory Investing Act, which would remove key tax benefits for major investors that acquire large numbers of single-family rental homes.

This would discourage millionaires and beyond from having monopoly-like control on the housing market in certain low-income areas.

The main talking point by Harris in rallies and interviews in regard to housing has been promising to provide working families who have paid their rent on time for two years and are buying their first home, up to $25,000 in down-payment assistance.

This is where Harris’ plan to increase housing is key, if there is more supply along with demand, prices of homes will decrease thus making the down-payment assistance even more impactful.

What does this economic plan cost, mean in terms of taxes?

Harris’s tax plan relies on higher taxes on businesses and the wealthy through unrealized capital gains to raise new revenue.

According to the Wharton Budget Model, the Harris campaign’s proposed expansions of the CTC, EITC, and ACA premium tax credits would cost more than $2.1 trillion over the next 10 years.

“Down payment assistance for first-time homebuyers would add another $140 billion in costs, which we estimate to assist 1.4 million homebuyers annually,” Wharton researchers concluded. “Raising the corporate tax rate to 28% would raise about $1.1 trillion in new revenue, offsetting slightly less than half of the cost of the other provisions.”

Harris said she intends to increase the corporate income tax rate from 21% to 28% as opposed to former President Donald Trump who advocates for it to be 15%.

This shows the contrast in the two candidates’ strategies. Harris is looking for money through taxing the wealthy and corporations, while Trump wants to lower taxes for all but potentially increase prices by putting tariffs on certain imported goods. Time will tell which candidate gets to enact their policies and if they’ll work.

A Harris Poll conducted for the Guardian newspaper this week shows that Harris’ economic proposals are more popular than Trump’s. In a blind test of 12 policy ideas — six from each candidate — four of the top five most popular were from Harris’ campaign.

The most favored proposal was Harris’ federal ban on price gouging for food and groceries, with 44% of respondents supporting it. Other top Harris policies included expanding the Child Tax Credit and tax breaks for new small businesses, both supported by 43% of respondents.

Trump’s only top five policy was his plan to eliminate taxes on Social Security benefits, which garnered 42% support. While Trump’s policies remain popular with Republicans, Harris’ platform resonated more with independents and younger voters, particularly millennials and Gen Z.

“Though Harris has received criticism for being ‘light on policy,’ a majority of all voters in the poll suggested they understand her policies just fine,” researchers wrote. “More than 60% of voters said they understood Harris’ policies on the economy.”

The post Harris Campaign’s Key Economic Policies Highlighted Ahead of Presidential Election appeared first on The Washington Informer.