More than 20 years ago, amid rising rents and gentrification, a pair of nonprofit community developers teamed up with the city of Boston to build and sell affordable housing units to families on the back side of Mission Hill.

The single- and two-family homes constructed by the Back of the Hill Community Development Corporation and the Jamaica Plain Neighborhood Development Corporation were sold in a widely subscribed lottery for about $200,000 each.

Today, some of those units on the Roxbury-Jamaica Plain line could fetch as much as $1.3 million on the open market, according to a local realtor’s analysis.

For the 34 income-qualified households lucky enough to benefit from the Back of the Hill bargain, the deal came with several catches. The restrictions include a long-term cap on how much they could re-sell the properties for and the need for city approval to refinance their loans to pull equity from their units to cover such expenses as their kids’ college education, a vacation, or property upgrades.

The Back of the Hill compact with the city allows households to pass along their homes as an inheritance but the heirs must sell the properties if they are not qualified as low income. They can keep the money but have to give up the houses.

Under an appreciation formula set by the city after it sold the land to developers for as little as $1 a parcel, sale prices cannot exceed a 5% annual mark-up from what they originally paid. As a result, the maximum sales price for a home being sold in 2024 by an original owner cannot change hands for more than about $600,000 — still a windfall of as much as $400,000.

Thus far, only a handful of the Back of the Hill (BOTH) units have been refinanced or used to generate home-equity loans, according to Suffolk County Registry of Deeds records. They are among some 3,000 units developed with deed restrictions in Boston in neighborhoods throughout the city.

Now, some would like to see the deed restrictions loosened.

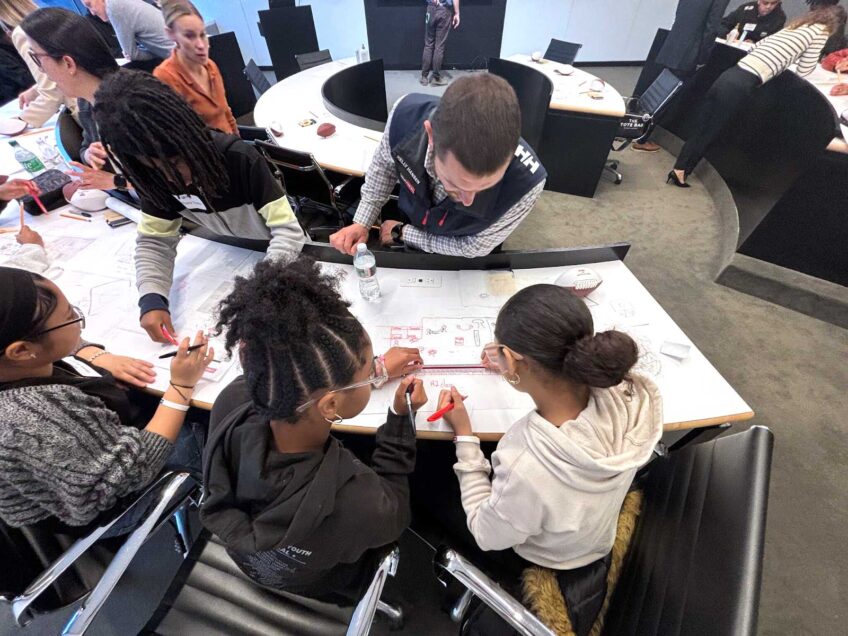

During a Boston City Council hearing called last week by District 7 Councilor Tania Fernandes Anderson, who represents Roxbury, city officials and housing advocates on both sides of the equity debate aired their views on how to balance the needs of long-term housing affordability with the desire of current homeowners to draw wealth from their property investments.

Sheila Dillon, director of Boston’s Office of Housing, acknowledged the tension during an interview after testifying before the council. Boston must “balance the need for affordable home ownership in a city that has become completely unaffordable,” she said.

At the same time, Dillon added, homeowners who have put years of investments into their properties must have opportunities “to realize equity.”

Deed restrictions lasting as long as 50 years were designed to keep prices within reach of moderate-income households — and the restrictions have the support of such grassroots leaders as John Smith, director of the Dudley Street Neighborhood Initiative, who testified in support of perpetual restrictions.

Most restrictions last 30 years and the city retains the option of extending them for another 20 — an extension the city is willing to waive for original owners. According to the city, deed restrictions for newer units coming on the market were changed several years ago to drop the requirement that forced heirs to sell if they did not meet income guidelines.

None of that, says the city, stands in the way of households taking out equity loans to draw cash from their properties.

However, some advocates and homeowners testified that buyers never signed disclosure documents acknowledging deed restrictions, or were unaware of them while initialing a blizzard of fine-print copy.

Further complicating the picture is the involvement of the Massachusetts Affordable Housing Trust Fund in the development of later phases of the Back of the Hill units. State law requires that projects funded by the trust “remain affordable for the longest period reasonably achievable.”

At a time policymakers are increasingly focused on ways to narrow the intergenerational wealth gap between white households and households of color, some argue that restrictions should be dropped altogether to allow the mostly minority families in the BOTH units to realize wealth gain.

Former state Sen. Dianne Wilkerson argued as much in her testimony at City Hall and in a recent opinion piece published in the Banner.

“While the city is constantly professing that racial equity and wealth creation is not just a goal but a priority, their homeownership policies suggest just the opposite,” she wrote.

To the families who bought BOTH homes on Heath Street or the avenues hugging the hillside above, the properties represent an opportunity to get some payback for the money they’ve put into the neighborhood and the stabilizing force they’ve brought to an area once dominated by warehouses, industrial use and the nearby Mildred C. Hailey public housing development.

Esther Onuoha bought her home in 2001 when Mission Hill was a “no-go zone,” she said. “We endured a lot of dangers. We endured a lot of abuse,” said Onuoha, adding that homeowners persevered by paying their mortgages. “That’s why we’re talking about neighborhood stabilization today.”

Homeowners at the hearing found an ally in City Council President Ruthzee Louijeune.

“My staffer lives in one of these,” Louijeune said, voicing her determination to advance their “ability to realize the gains of their capital improvements” and access home equity credit.

Calling for solutions to “onerous terms, especially ones that they don’t understand or never really agreed to,” the council president said, “It doesn’t make sense that there wasn’t that education done on the front end to ensure that people understood what they were signing. That’s a problem.”

Myrthlene Smith, 62, of Wensley Street, a BOTH homeowner who attended the hearing, said she was unaware of any restrictions because she never signed any documents acknowledging them. “We never got that paper to sign, that deed restriction,” she said.

A retired nurse and grandmother of 10, Smith said to the city, “You own my house even though I paid for it.”

She added, “After 20 years, it’s all the folks like me who’s looking to pass on to our children, our grandchildren.”

While acknowledging there may have been some confusion at closings, both city officials and developers asserted that homebuyers signed all the proper paperwork.

Kathy Brown, a member of the Jamaica Plain Neighborhood Development Corporation and executive director of the Boston Tenant Coalition, said she supports deed restrictions and testified that the limitations were explained to winners of the housing lottery during the sales process.

“I mean whatever their different perceptions, there’s other documents that have been signed,” she said.

Richard Taylor, a prominent Roxbury developer argued for terms of not more than five or 10 years, calling 50-year deed restrictions “ridiculous.”

“Housing is wealth to borrow against and profit from,” Taylor said. “That’s called America.”

Councilor Fernandes Anderson said 30-year restrictions are more than sufficient. “I don’t necessarily believe that it needs to be 50 years,” she said, as long as the city makes “a guarantee that we will be replacing that stock.”

“It hurts to have invested in a property that you felt could be your opportunity to build equity, but then to discover that it is not,” she said.

Wilkerson said the dispute is unlikely to be resolved through policy discussions.

“This, unfortunately, is going to get resolved in court,” she said.