Banner Business Sponsored by The Boston Foundation

Black banks have a long history in the United States — but also a history of challenges.

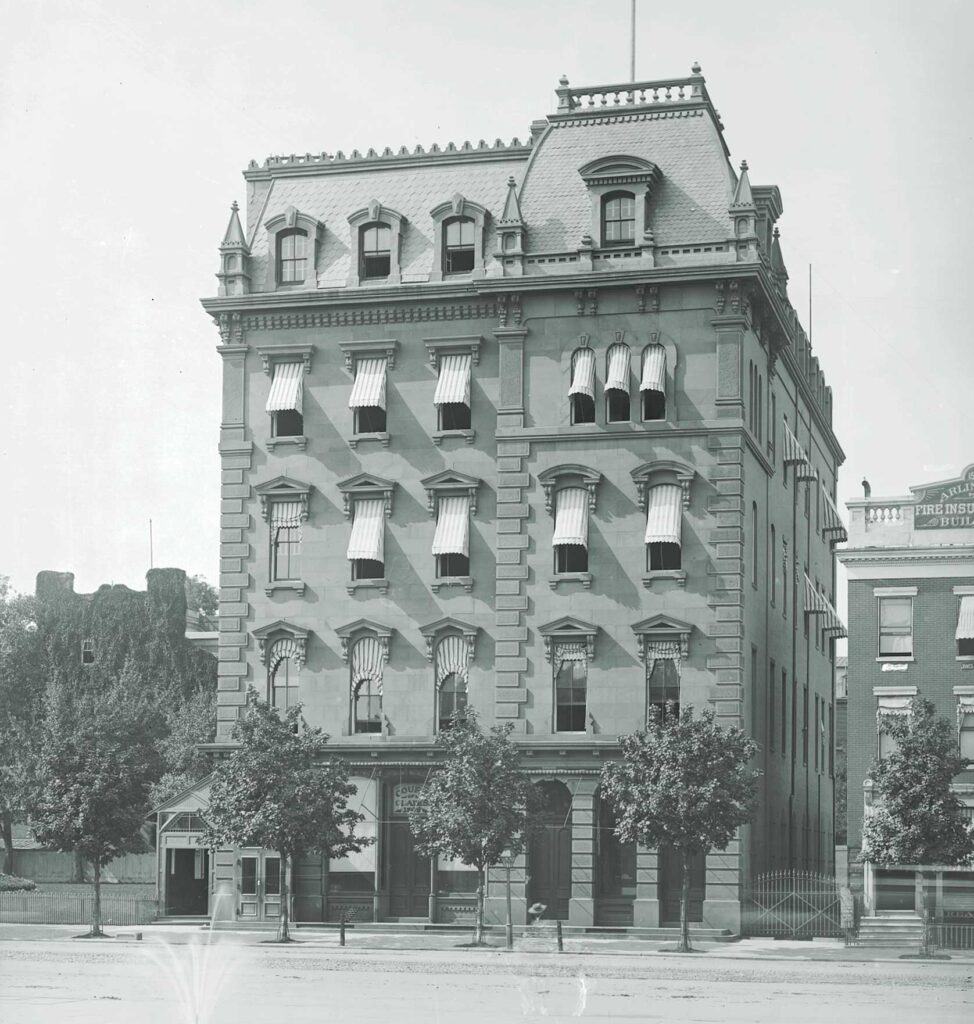

The first Black bank, Freedman’s Savings Bank, was founded by an act of Congress and signed into existence by Abraham Lincoln in 1865 to hold deposits of people who were newly emancipated from slavery.

This bank had a national footprint with 37 branches opened across the 17 states and held assets of approximately $3.7 million in 1872. As the bank grew, it helped establish a working and middle class in the Black community.

Unfortunately the bank was horribly mismanaged by its trustees. As Frederick Douglass would comment later, the bank was “the black man’s cow, but the white man’s milk.” The bank did not survive the financial panic of 1873 and closed in June 1874.

Black banks, considered Minority Depository Institutions — or MDIs — continued to grow in spite of the Freedman’s failure, with 134 Black-owned banks opened by 1934. Today, only 22 remain.

The FDIC promotes partnerships between MDIs and the nation’s largest banks. Citigroup had such a partnership and offered customers of participating MDIs a discount when using their ATMs and waived any out-of-network fee at Citibank ATM branches.

This project, however, is now under attack by a lawsuit claiming the policy is racist because it offers discounts only to MDIs and not white-owned banks. This partnership with Citigroup offers real support for MDIs, who do not have as large a footprint.

According to Citigroup, this program has been successful in removing fees for close to 440,000 customers and serves to “alleviate one of the biggest barriers to banking.” ATM fees are a trillion-dollar business for banks and can cause accounts to be overdrawn, causing more fees.

This lawsuit is another example of targeting any reparative actions institutions are taking to fully include Black people. The law firm bringing the suit is the same firm that represented Students for Fair Admissions in its Supreme Court case to eliminate affirmative action in college admissions. Their complaint is clear, claiming “Citi intentionally discriminated against Plaintiffs and those similarly situated for banking with financial institutions owned by people of the wrong race.”

The argument simply ignores the historical and violent exclusion of Black people in banking and wealth creation.

Jessica Guynn summed it up well when she wrote for USA Today, “Programs like Citigroup’s are intended to combat racial inequality and expand access to underserved low-income Black and Hispanic communities historically susceptible to redlining — the discriminatory practice of excluding poorer minority areas from financial services.”

This partnership is offered to over one million MDI customers nationally and reduces ATM fees at over 2,300 locations including New York, Chicago and Los Angeles.

Closing the wealth gap must include Black banks because traditional banks are not reaching Black families.

The Federal Reserve reported in 2019 that close to 50% of Black households are underbanked, and the U.S. Census Bureau reported that Black families are rejected at twice the rates of white applicants.

As Boston-based One United Bank describes in its blog post on the importance of Black banks: “Black banks serve Black people. In neighborhoods created by discriminatory practices like redlining, Black-owned banks are often the only source for reasonable, fair and non-predatory lending.”