UMass students carry schools’ debt

Campus building projects costing students $2,500 a year on average

During Vanessa Snow’s four years at UMass Amherst, new buildings went up almost as fast as her tuition: A new student union, new luxury dorms to attract out-of-state students, a residential cluster for the Honors College, several new science buildings.

When Snow graduated in 2009 with $84,000 in debt, a portion of that paid for those new buildings.

“There were tuition and fee increases every year,” Snow said.

This year, two professors in the UMass system have put a number on the portion of debt students are carrying from building and maintenance projects in the UMass system — $2,500 a year, on average.

“It wasn’t always this way,” notes Salem State University professor emeritus Richard Levy, who co-authored a report on the debt burden borne by students. “Twenty years ago, Salem State’s library was condemned and rebuilt. Ninety-five percent of that was paid for by the commonwealth.”

Yet this year, as Salem State is undergoing $85 million in renovations to its buildings, the state is picking up $35 million of the cost, just 41%.

“A lot of the rest gets put on the students,” Levy says.

In all, the UMass system has $3 billion in capital debt. Other Massachusetts public colleges, including Salem State, have $1.2 billion. Community colleges, which don’t generate the revenue state colleges and universities do, have more than $1 billion in deferred maintenance.

According to the report, campus capital debt increases student loans by 25% on average. The increased costs and indebtedness are part of the reason the cost of attending Massachusetts state school system is increasing faster than in any state in the nation. Massachusetts ranks second in the nation in the rate of student loan debt growth.

“That particularly hurts low-income students,” Levy noted.

Part of what’s driving the building boom in the UMass system is what many see as a need to attract out-of-state students who pay higher tuition. Dormitories, new dining halls and student centers are widely seen as a reliable way to attract students paying full freight.

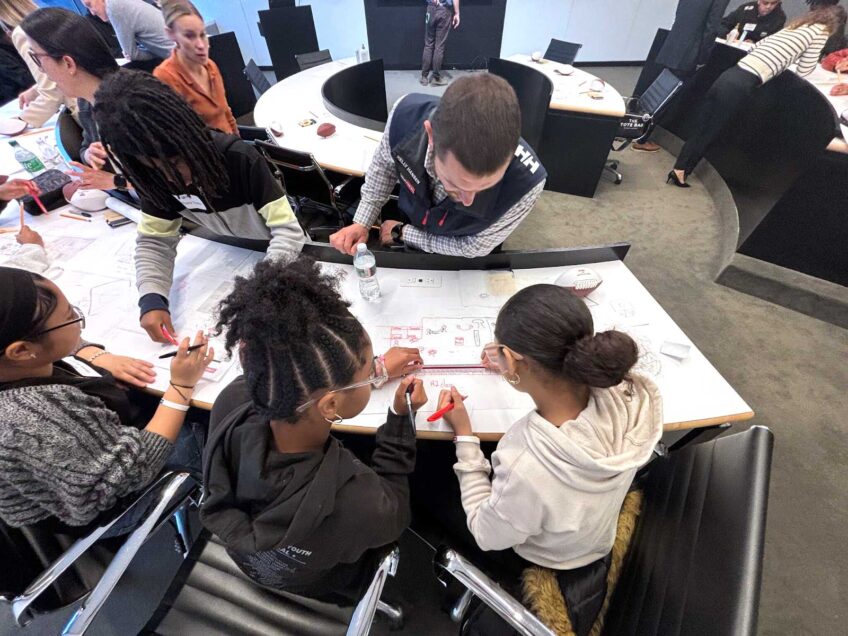

At UMass Boston — a school that has long stood out as an exception to the typical college demographic, with its largely working-class student body that is majority people of color and majority women — the campus has seen construction of a new science center and new student housing as well as costly repairs to academic and administrative buildings and to a water-damaged underground parking facility.

The costs of all this, as borne by the students, comes out to $3,800 a year per student, according to Levy’s study.

“To think that $3,800 of what I paid went into that — it’s kind of shocking,” said recent UMass Boston graduate Galicia Escarfullery, who works in the nonprofit sector. “You would expect a state school to not put that burden on students.”

But Massachusetts has. Between 2001 and 2019, average tuition and fees for public campuses increased by about $6,100 per student, while state funding per student decreased by $2,790, according to an analysis by the Massachusetts Budget and Policy Center.

“Public higher education institutions passed the increasing costs of post-secondary education to students and parents by raising tuition and fees by almost 50% in the last 20 years,” said Claudio Martinez, executive director of the advocacy group Zero Debt Massachusetts. “Our most vulnerable students and parents carry a larger student loan debt burden in order to finance their post-secondary education dreams, a burden that is preventing them from starting families, creating businesses, going to grad school or buying a home.”

The pandemic has worsened the conditions for many. State colleges had turned to outside developers to build student housing, and those same schools were on the hook to continue payments to bond holders when their dormitories closed during the pandemic, forcing many schools to make layoffs and cuts.

At Salem State, administrators called for a five-week furlough. But after more than 3,000 students protested, the university rolled the furlough back to two weeks.

Administrators then sought other cost savings.

“We’re facing constant pressure to reduce the number of majors,” Levy said. “We’ve been forced to reduce the number of classes. When you do that, students can’t get the classes they need to graduate in four years, and have to come back for additional semesters. That puts more pressure on them.”

For Snow, the UMass Amherst grad, the pressure came in the form of student loan payments so high, she often had to put them in forbearance during the first six years after she graduated.

“My loans easily exceeded the cost of rent,” she said.

Levy said he’s seen a change in students as they’ve become more cost-burdened. More of them are holding two and three jobs, arrive in class tired and cannot make office hours due to work schedules.

At the same time, budget cuts have cut support services for students, such as counselors and financial aid officers, leaving students to navigate complicated systems on their own.

Some measure of relief may be around the corner. State Sen. Joanne Comerford filed the Cherish Act, legislation that would require the state to fund public higher education at the level it was funded in 2001, adjusted for inflation. The legislation would also commit another $500 million in funding for public higher education to supplement existing funding.

“It would really be a substantial move in the right direction,” Levy said of the Cherish Act.

Other legislative proposals include the Debt Free Future Act, sponsored by Sen. Jamie Eldridge and Rep. Natalie Higgins, which would create a grant program to cover tuition and fees for all Massachusetts residents and cover additional costs, such as housing, transportation and books for low-income students.

The Endowment Tax Act, sponsored by Higgins and Sen. Adam Gomez, would impose a 2.5% excise tax on the 11 private higher education institutions in the state that have endowments over $1 billion and dedicate the estimated $1.6 billion in yearly revenue to public higher education.

Also on the horizon is the Fair Share Amendment, a ballot question often referred to as the millionaire tax, which would tax income over $1 million at 9%, instead of the 5% flat rate at which the state currently taxes income. That amendment would commit the estimated $2 billion raised to public K-12 and higher education and to transportation. Voters have polled in favor of the amendment, which will appear on the ballot Nov. 8.