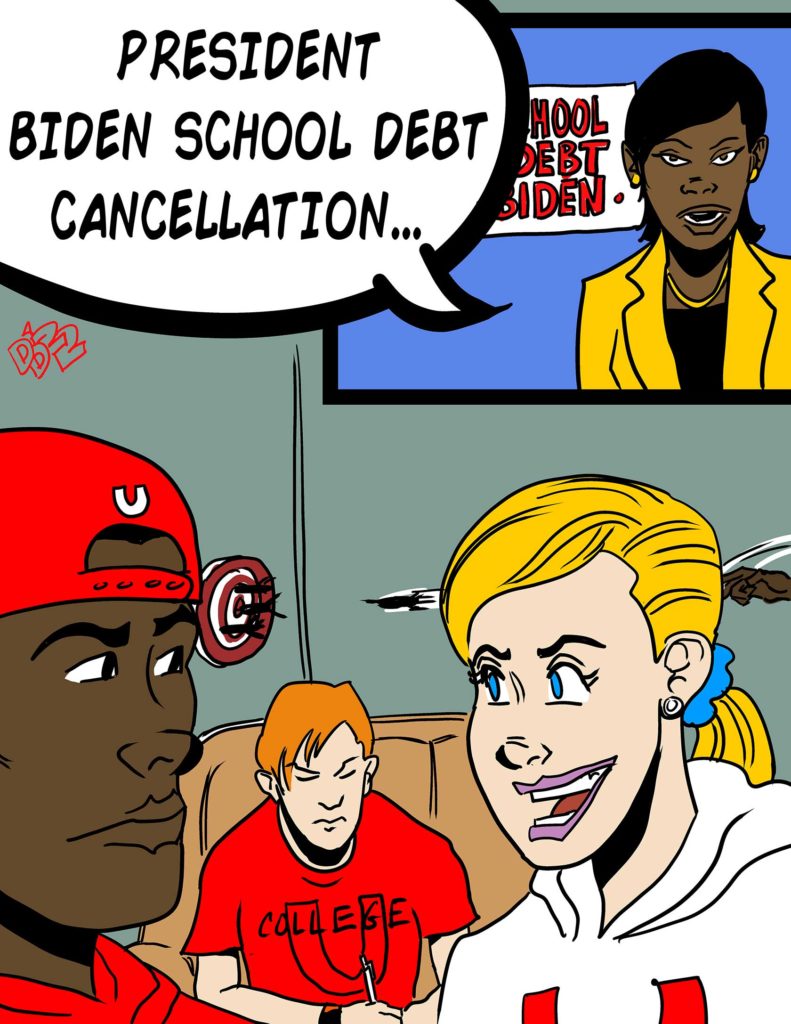

During his campaign for president, Joe Biden promised to alleviate the enormous debt that so many Americans had assumed to finance their college educations. The debt had climbed to about $1.75 trillion, surpassing the nation’s credit card debt. Biden recently announced a loan modification plan that would reduce $10,000 or $20,000 for qualified debt holders. The plan would reduce the debt for an estimated 41 million creditors.

Under the plan, individuals earning less than $125,000 or households earning less than $250,000 per year get $10,000 off on their education bill. However, Pell Grant recipients can have up to $20,000 eliminated from their debt. According to a financial analysis of the program, an estimated 3.8 million Blacks with student loans could have their entire debt eliminated.

As promising as this program is, many of those who would still be left with debt that was not eliminated have voiced their complaint. And that’s not the only source of objection. Those who paid off their student loans by the sweat of their brow, according to reports, feel short-changed. Political conservatives who object to Social Security, government-financed health care and most other citizen benefits for the socially disadvantaged are expected to oppose the substantial federal government cost of Biden’s program.

Another source of opposition could be finance and debt service companies that have structured profit-generating divisions to handle the debt. From their perspective, the reduction of the student loans amounts to a loss in sales for a significant financial sector. Consequently, there are several sectors of society that will be less than enthusiastic about the plan to brighten the lives of Americans burdened with student loan debt.

Unfortunately, there are several elements in the plan that open an opportunity for litigation or reduce the amount of the benefits awarded. The fundamental weakness is that Biden has used his executive authority to establish the debt forgiveness program, but he must still find funds that have been approved by Congress to be spent in that way. It is reasonable to expect that conservatives will bring suit on the issue of whether the source of funds have been properly attained.

Biden and Democratic Party leaders intend to implement the plan. It would be very impractical for anyone benefiting from the cut in his or her student loan debt to criticize Biden if opposition develops and becomes heated. The wiser course of action is to take the reduction awarded and not give political support to those opposed.

Also be aware that those with a debt reduction might have to pay taxes on the amount in some states. Consequently, the benefit would not be for the full amount of the award. So there will have to be some political action in the various states.

After Labor Day, the most significant political issues are political involvement in the midterm elections and strong support for Biden’s implementation of the student loan abatements. Both will test the reliability of the Democratic Party’s ability to get things done.