During the Civil Rights Movement, the most highly sought objective was voting rights. Next in line to that was access to quality education. The U.S. Supreme Court decision in Brown v. Board of Education in 1954 inspired hope in Blacks across the nation. However, the historic white resistance to the concept of multiracial education in public schools has retarded the full implementation of that policy. Nonetheless, Blacks have been enrolling in expensive college programs at a great rate.

Blacks have to do the best with educational opportunities that are available. It is unacceptable for Black students to be disgruntled and become poor students because whites in authority lack the character to provide quality education for all youngsters in America. With a highly technological economy, it is not enough simply to graduate from high school in order to earn enough to support a family at a reasonable level.

With college education now so expensive, teenagers are forced to consider whether college is really worth it. According to the data of the U.S. Bureau of Labor Statistics, higher education will pay for itself if the student is careful and analytical about the financial commitment to advanced education programs. The median annual income of those with no more than a high school diploma is only $38,792. With today’s prices, that is clearly not enough.

However, an associate degree, which one can acquire at modestly priced community colleges, lifts that income level to $46,124. But it does even more than that. Properly selected courses will prepare the avid student to transfer to the state college with some preliminary academic credits. The median income level upon obtaining the bachelor’s degree is $64,896 per year. A master’s degree will add a bit more than $1,000 per month to that level.

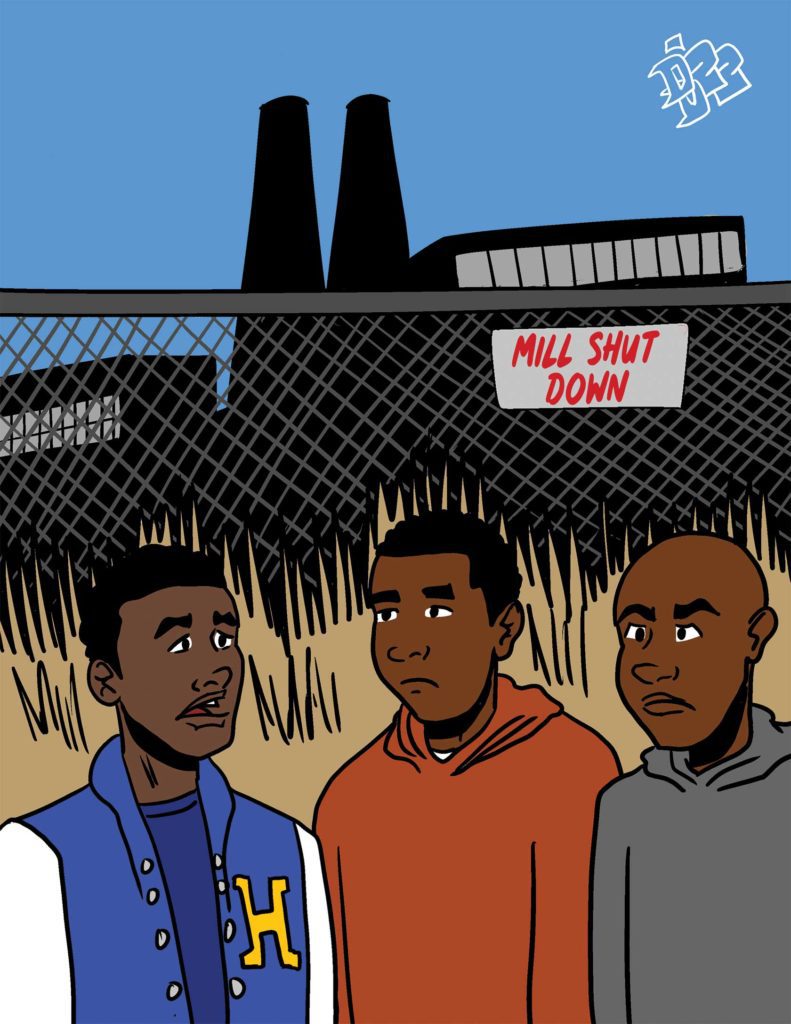

Despite the increasing cost of a college education, there is still the usual necessity of having a college degree to generate a middle-class income. But there has been a loss of 465,000 students enrolled in college since the fall of 2019, according to the National Student Clearinghouse Research Center.

A major reason for the decline, in addition to Covid-19, is that job openings are at a historic level, so some high school graduates have decided to take the available jobs and avoid the expense of obtaining a college degree. That makes sense in the short run, in order to avoid the staggering expense of college loans, but it could impair job advancement in the future.

These days, a high school graduate has to have the financial acuity of a Wall Street analyst to determine the most feasible plan to finance a college education. There is every reason for students to be concerned about incurring debt. Americans now owe about $1.75 trillion in student loan debt. That is almost $440 billion more than the total amount people owe on auto loans.

What is worse, a number of for-profit colleges have failed to provide students what they promised. The U.S. Department of Education has approved the discharge of student loans provided to finance the education of schools that failed to perform the services that they advertised. About $415 million in defense claims for repayment of federal loans have been approved against DeVry University, Westwood College and the nursing programs at ITT Technical Institute. The students who filed complaints have been relieved from loan repayment, and the government will have to move against the colleges to recover the sums.

The first step for students who plan to go to college is to study diligently and get good grades to earn scholarships and grants. If the school you are interested in is associated with the Jobs for the Future program, you will be able to obtain advice and direction from a well-informed associate. At any rate, skilled guidance will be necessary for you to make the most advantageous decisions.

Nothing is more unfortunate than a student making an ill-advised college commitment and then being financially stuck for years with an unrelenting education bill. But the right move can change the quality of one’s life.