America’s biggest bank planted official roots last week in Mattapan Square with the cutting of a Chase-logo ribbon by America’s most powerful banker.

For the New York-based financial behemoth, the event marked the formal opening of its 32nd branch in Massachusetts and the launch of its first Bay State “community center bank” as part of a $30 billion, multiyear racial equity initiative.

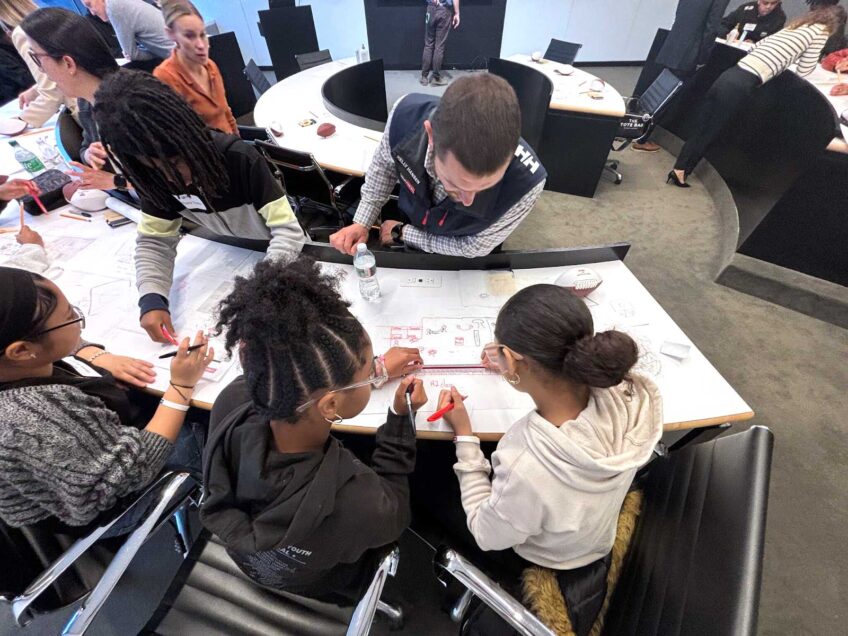

Since opening its doors in August, the brick bank building along busy Blue Hill Avenue has hosted not just tellers and a vault, but also mortgage and home-buying seminars, training in financial literacy and small-business development mentorship.

“We want to be welcoming,” said JPMorgan Chase Chairman Jamie Dimon, who walked into the bank with an entourage more akin to a president’s visit than a pinstriped banker’s. “I want to walk down the street and shake the hand of every businessperson in the neighborhood and make sure they know they’re welcome to come here.”

The community banking center concept took shape as JPMorgan Chase, the parent company of its Chase consumer banking division, sought to address social and racial injustice in the wake of the killing of George Floyd last year. According to Dimon, the effort is part of the bank’s commitment to broadening the concept of “shareholder value,” which he said should look beyond quarterly reports and embrace positive social and economic change.

With over $3.4 trillion in assets, the bank opened 10 new community branches before making Mattapan its 11th. They join 4,800 branches nationwide.

Before the ribbon-cutting, the bank’s longtime chairman and chief executive officer broke away from taking selfies with excited bank staff to explain the bank’s social mission.

“Think of Black loan officers working in these neighborhoods helping to make mortgages here,” he said, speaking in the rapid-fire cadence of his native Queens, New York. “We’ll learn from that experience and maybe we’ll learn to change the credit box,” he added, referring to calculations of loan eligibility.

“Business has a responsibility to help solve challenges facing the customers and communities it serves,” he said, “and that includes addressing longstanding racial and economic inequities that affect far too many neighbors.”

Dimon has opened community center branches in Harlem, the Anacostia neighborhood of Washington, D.C., Crenshaw in Los Angeles, Southside Chicago, Detroit, and in Minneapolis, just a few blocks from where George Floyd was murdered by a police officer.

“We started with 15,” he said. “If this works out, we may open 1,500 community branches down the road.”

While investing in brick-and-mortar banking, the company also has poured $13 million since 2018 into social-impact spending with affordable housing development and skills-training organizations in the Bay State, including Dorchester Bay Economic Development Corporation, Just-A-Start and the Massachusetts Affordable Housing Alliance.

With jazz chords from a Berklee College of Music ensemble floating in the air, Mattapan branch manager Brian Samuel said his aim was to give the community “a solid financial foundation” and that he appreciated the presence of the bank’s chairman to back up that commitment. “It means everything for someone of his stature and importance to come to little Mattapan and christen this branch,” he said.

Sabrina Correia, the branch’s community manager who oversees its neighborhood relationships and financial health programs, said she hopes “to accomplish the vision of helping the people of this community to make the most of their lives.”

The new Mattapan branch is part of a banking conglomerate with history stretching back to the earliest days of U.S. commerce. The Chase name comes from Chase Manhattan, which traces its origins to a company formed by Aaron Burr in 1799 to supply water to New York to fight a yellow fever epidemic, according to the nonprofit Corporate Research Project.

Chase Manhattan flourished under the grandson of Standard Oil tycoon John D. Rockefeller and was eventually merged with the infamous House of Morgan — the investment bank J.P. Morgan & Co. formed by the “robber baron” who was the leading financier of America’s Gilded Age.

In remarks to reporters, Dimon displayed his own sense of historical perspective, responding to a question about a mural on the bank’s rear wall showing images of Marcus Garvey and Haitian revolutionary leader Toussaint L’Ouverture. He launched into a detailed description of Napoleon’s army chased from Haiti by the former slaves.

Like many Mattapan residents, Dimon was born into an immigrant family. His Greek parents and grandparents instilled in him a deep work ethic and a respect for all humanity that informs his approach to banking, he said.

Longtime friendships with such figures as the late Vernon Jordan and Colin Powell later involved Dimon in efforts to improve educational opportunities for inner-city kids, he said.

As for the bank’s commitment to economic justice in the broad racial reckoning of the last two years, Dimon said JPMorgan Chase has already committed $13 billion of its $30 billion pledge, which includes some $40 million for investments in minority-owned banks and expanding its $2 billion spent on minority vendors in 2020.

The bank will continue to diversify its workforce, he added, taking a shot at industries and companies with more opaque hiring records that are not, like banks, subject to federal Community Reinvestment Act disclosures.

“I walk into rooms sometimes and the only Black people in the room are bankers from JPMorgan,” he said.

To increase diversity, he said, “I would look at private companies, at private equity firms, at some hedge funds, at some law firms. We all know we haven’t gotten close to parity, and it’s been 160 years since the Civil War. The problems are deep. It’s hiring, training, diversity, it’s mortgages and small businesses and it’s inner-city schools and education. There’s a lot of work to be done.”