Drake, Other Celebrities Back Financial Firm’s Efforts To Offset Their Carbon Footprints

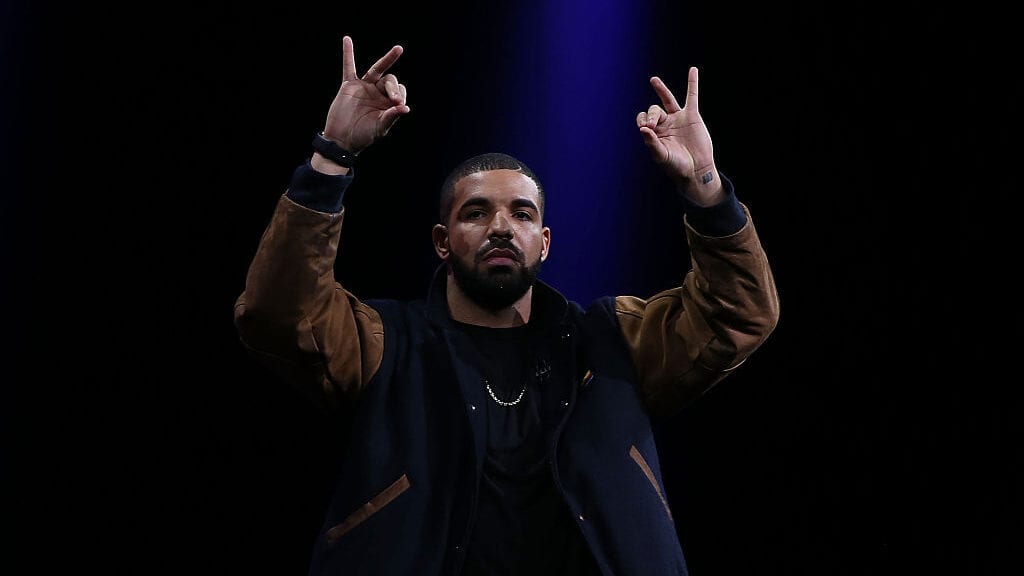

Grammy-winning rapper Drake is the latest among a group of celebrities — including actors Robert Downey Jr., Leonardo DiCaprio and Orlando Bloom — teaming up with California-based Aspiration to find ways to reduce the large carbon footprint that comes with being an international superstar.

The environmentally friendly financial services company will audit Drake’s schedule, events and travel to calculate his carbon footprint. Part of Aspiration’s approach includes a reforestation program that plants millions of trees around the country to offset carbon overload.

For Drake, who had 31 concert dates in 2019 spanning Los Angeles to Rio de Janeiro and London to Paris, his private jet — dubbed “Air Drake”— the impact of his carbon footprint takes some calculating.

“Drake’s carbon footprint is bigger than yours or mine,” said Andrei Cherny, CEO of Aspiration. “If Aspiration is able to help [him] cut out his negative impact on the planet, we can help everyone.”

He commends Drake for leading what he describes as “a cultural movement to inspire people to take easy, automated, personalized actions to fight the climate crisis.”

Data on the actual calculation of Drake’s carbon footprint was unavailable, but a proprietary algorithm makes it easy to establish carbon neutrality, according to Aspiration. The firm will also engage a third-party auditor to validate Drake’s activities as carbon-neutral.

“We have software that takes the input of an individual or corporation in all parts of their activities: transportation, production of products, and the carbon footprint of the consumers that are consuming those products,” said Aspiration co-founder Joe Sanberg. “Based on the data we get from our clients, including Drake, we’re able to calculate the carbon emissions of all those activities, and then we’re able to calculate how many trees through our reforestation program we need to plant and for what period of time.”

A reforestation program is one way the financial services firm helps offset clients’ carbon footprint. (Brian Garrity/Unsplash)

A reforestation program is one way the financial services firm helps offset clients’ carbon footprint. (Brian Garrity/Unsplash)

It takes a little over 1,000 trees planted to offset the average person’s emissions, with each absorbing about 31 pounds of carbon dioxide, according to the nonprofit conservation group Saving Nature.

“It’s exciting to partner with a company that’s found an easy way to offer everyone the ability to reduce their carbon footprint,” Drake said in a statement. “Aspiration’s innovative approach to combating climate change is really inspiring, and I hope together we can help to motivate and create awareness.”

Sustainability built in

Cherny, an economic policy expert and former speechwriter for President Bill Clinton, and Sanberg, a progressive entrepreneur and investor, co-founded Aspiration in 2013 and opened for business in 2015. Since the launch, the company has gained 4 million customers and $250 million in backing from investors, including Downey Jr., DiCaprio and Bloom.

Though the company provides everyday banking products, Sanberg describes Aspiration as a “sustainability services provider,” rather than a conventional bank.

“We provide financial products like banking accounts, investment products and a credit card,” he said. “All of these products are made special by the automated sustainability features they have attached to them. So you can turn those everyday financial products into more than where you deposit your paycheck or what to use to buy your groceries.”

In the past year, the company’s individual and business customers have funded the planting of more than 15 million trees in the United States, Sanberg said, adding that there are plans to plant more than 5 billion over the next 20 years.

Aspiration’s efforts include the “Plant Your Change” program, which allows customers to round up any transaction to the nearest dollar to plant a tree through the company’s reforestation program. The Aspiration Redwood Fund is a sustainable mutual fund that invests only in eco-friendly companies. The Planet Protection Program tallies up drivers’ carbon output and then buys carbon offsets to counter the climate impact.

The company also offers a mobile application — Aspiration Impact Measurement, or AIM — that uses more than 75,000 data points to gauge a company’s sustainability.

“It’s like a FitBit for your sustainability that shows how the places you use your Aspiration card treats their workers and the environment,” said Sanberg.

AIM’s “people” scores reflects company metrics like employee pay, access to health care and workforce diversity. “Planet” scores measure greenhouse gas emissions, energy efficiency and renewable energy use.

“The cold hard truth is that most people are depositing their money in the big financial institutions, which use that money to fund loans to oil, gas, coal, firearms and private prison companies,” Sanberg said. “When they find out that their money is being used to violate their values, they want to switch, and they know that at Aspiration, their money is never lent for those kinds of activities.

“When you deposit your money at Aspiration, we place it at one of the commercial banks in our commercial bank network that makes loans to individuals who are buying homes or starting small businesses.”

Future product offerings, Sanberg said, will include carbon-neutral insurance and “green” mortgages.

Sustainability trending upward in banking

Aspiration’s leaders believe that the market for sustainability services will grow dramatically over time.

“There’s not a year in the foreseeable future in which fewer people are going to want to take personal action to fight the climate crisis,” Cherny said. “Aspiration is unique because what we’re delivering is sustainability itself — helping people and companies easily and automatically integrate sustainable actions into daily life.”

“Corporations are going from not paying for sustainability services to paying for them in a short period of time,” said Sanberg. “I think about it like the adoption of websites 25 years ago. In a short period of time, every company went from not having a website to having a website.”

Zilvinas Bareisis, head of retail banking at Celent, a Boston-based advisory firm, states in a research paper that the banking industry is taking significant steps to reverse the effects of climate change.

“As the Paris Agreement aiming to limit global warming came into force in 2016, banks were becoming increasingly aware of the risks climate change was posing to their business,” Bareisis said. “While risk management still matters, the banks’ focus now is shifting to proactive efforts and what they can do to positively influence change.”

Bareisis’ paper also highlights a set of industry-developed guidelines for the future.

The Principles for Responsible Banking (PRB), announced during the UN General Assembly in September 2019, “provide framework for a sustainable banking system and help the industry to demonstrate how it makes a positive contribution to society.”

The PRB’s 235 signatory banks — with total assets of more than $60 trillion and coming from 69 countries — typically engage in lending to green initiatives, financing energy-efficient properties and issuing so-called green bonds tied to sustainability goals, much like Aspiration.

As a financial firm, not a chartered bank, Aspiration is not a PRB signatory institution. But its leaders view the company as singularly positioned to take on the climate change challenge through its traditional bank products.

“One of our opportunities is that we’re creating a brand-new category; there really isn’t a set of competitors out there,” said Sanberg. “We’re a unique one of one provider of sustainability services that are branded and technology-driven. There’s only one Aspiration brand, and that puts us in an interesting and privileged position, but also one where we have a lot of responsibility on our shoulders.”

(Edited by Judith Isacoff and Matthew B. Hall)

The post Drake, Other Celebrities Back Financial Firm’s Efforts To Offset Their Carbon Footprints appeared first on Zenger News.