If you own a business, you’ve only got days left to apply for a Paycheck Protection loan

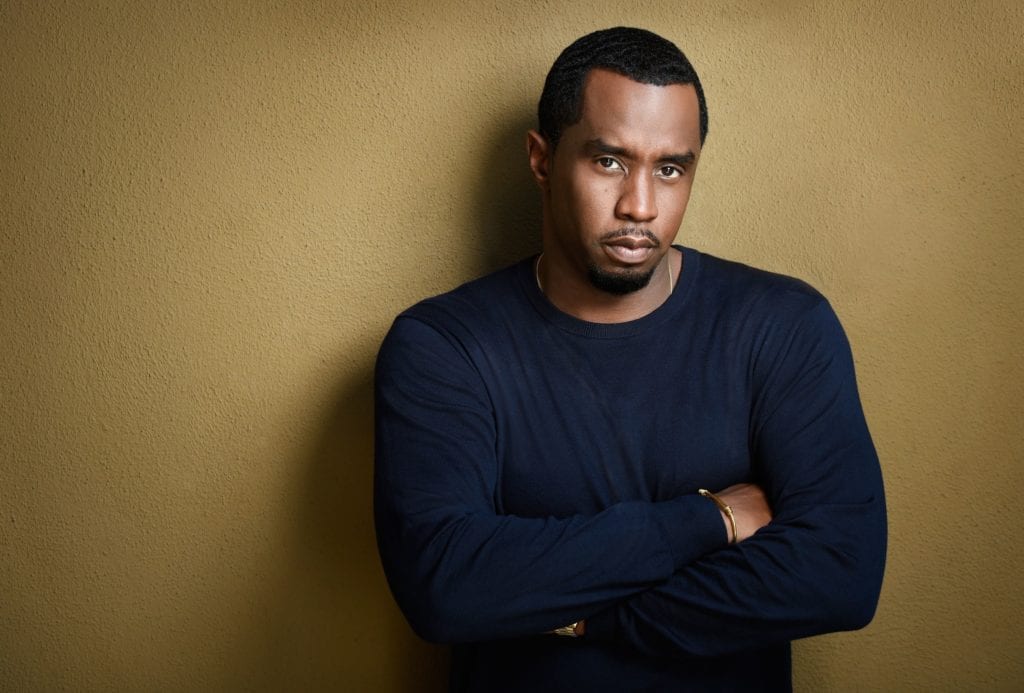

Jennifer Roberts, CEO, Chase Business Banking and Sean ‘Diddy’ Combs, Founder, Our Fair Share, entrepreneur and media mogul

In just four months last year, more than 5 million U.S. businesses received a Paycheck Protection Program (PPP) loan. That helped them pay their workers, their mortgage or rent, and their utility bills. Unfortunately, many small businesses owned by minorities, women and veterans didn’t get PPP loans last year. Here is what you need to know to make sure you know how to apply for the funding your business really needs. But you need to act quickly. PPP ends March 31, but many lenders may stop accepting applications sooner so they have time to process. That means you need to get started on an application quickly for PPP funds to help with your payroll costs and other bills, to get your fair share. The Small Business Administration (SBA) and participating lenders are working hard to make these loans available to more businesses in low- and moderate-income communities. And to smaller businesses, like barbershops, restaurants, nail salons, clothing brands, bars, bodegas and independent contractors.

Jennifer Roberts, CEO, Chase Business Banking

- Congress funded it with $284 billion for 2021. That’s enough for millions of more loans.

- It’s for first-time borrowers.The SBA has already approved more than 704,000 loans for borrowers who didn’t get one last year. The SBA also has approved loans for second-time borrowers.

- A PPP loan may be forgiven.Up to 100% of your loan could be forgiven if you qualify and meet the SBA’s requirements. That means you wouldn’t have to pay back the forgiven amount.

- Businesses with few employees get special attention.Through March 9, the SBA is accepting applications only from businesses with fewer than 20 employees.

- Most loans are relatively small.The average loan to first-time PPP borrowers this year is $22,000, the SBA says.

- Smaller businesses are getting approved.90% of Chase’s approved PPP loans in 2021 are to businesses with fewer than 20 employees.

- Help is available to understand PPP.com/ppp has a webinar, checklists and FAQs to walk you through the application process. You can also check out sba.gov/ppp.

- It’s easy to find participating lenders.The SBA’s website — gov/funding-programs/loans/lender-match — has a “Lender Match” link to help you connect to a lender near you.

The 2021 PPP is scheduled to expire March 31, but to get your application to the SBA by then, you need to act now. If you believe you are eligible, we urge you to find a lender, prepare your information and apply. Watch the interview with Sean Combs discuss the ‘Our Fair Share’ program.

This post has been contributed by Jennifer Roberts, CEO of Chase Business Banking as part of our Money Talk Financial Literacy partnership.