It’s never too early for children to start learning about financial literacy, and in order to encourage them, OneUnited Bank is holding its ninth annual “I Got Bank!” Youth Essay and Art Contest.

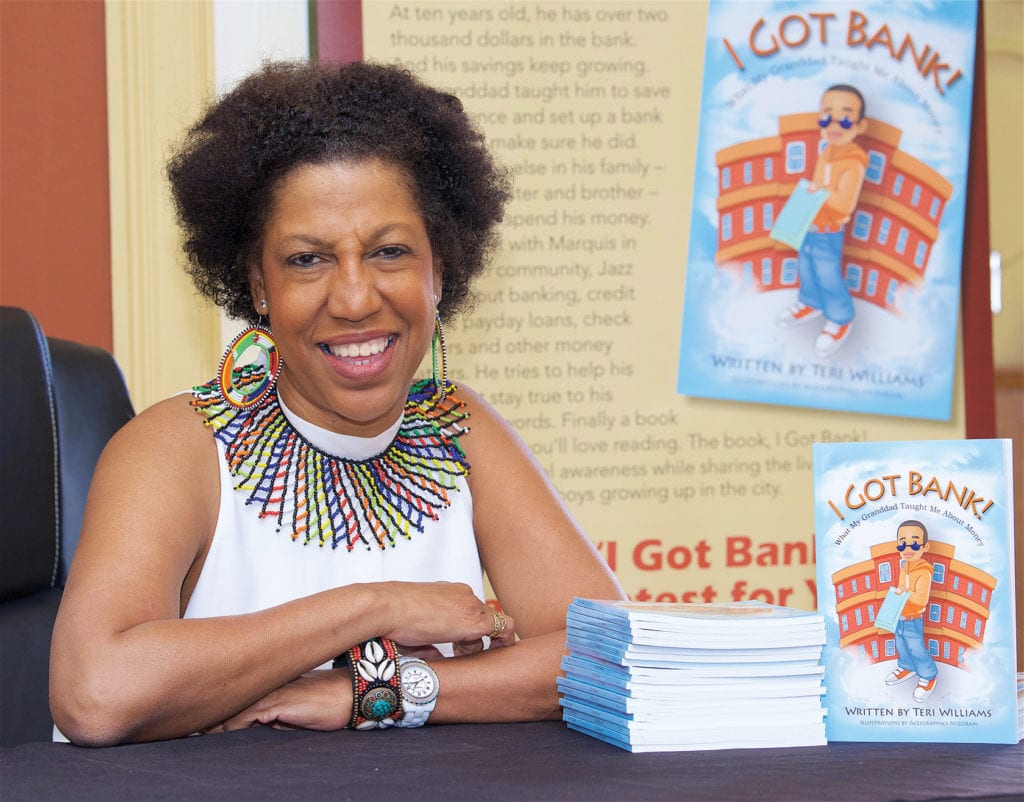

The contest, inspired by the book “I Got Bank: What My Granddad Taught Me About Money” by Teri Williams, president of OneUnited, gives ten children ages 8 to 12 the chance to win a $1,000 savings account.

To enter, kids can submit a 250-word essay or a piece of art inspired by “I Got Bank” or another financial literacy book.

The Banner spoke with Williams about the “I Got Bank” essay competition and the importance of teaching responsible personal finance habits.

Banner: What’s the importance of teaching children about banking and financial management?

Teri Williams: It’s important that children learn early how to wisely approach financial issues, so they can be successful and productive adults.

As children do, they soak up information and if that information is financial literacy, they will have good financial habits for the rest of their lives.

Can you share any highlights from last year’s responses to the “I Got Bank” essay competition?

Every child that participated in the I Got Bank Financial Literacy Contest loved learning about money! Light bulbs went off in their heads. Once taught, they “got it” and will have better money habits for life.

Here’s an excerpt from 2018 winner Jaedin Feaster, 8, of Roxbury, MA:

“What I learned from the book, I Got Bank, is that it is great to save money and it is even better to have a bank account, so you can let it grow. It is even more important to be able to say “no” to people who try to use your money. Another lesson that I learned is that you can work for money, for example, having a lemonade stand.”

What are the advantages to properly managing one’s personal finances?

The advantages to better money management are peace of mind, savings to take risks and build wealth and leaving generational wealth to our children and grandchildren.

What are the biggest mistakes people make with personal finance?

People neglect to automatically save, even if it’s a few dollars per week, which is the number one thing you can do to gain financial peace of mind and build wealth.

What are some simple steps people can take to get on better financial footing?

Set up an automatic savings plan with direct deposit, buy a house, even if it’s a hut, get at least basic life insurance and get a will and a health proxy.