Consumer scams proliferate, Federal Trade Commission urges caution

Multitude of scams include identity theft, illegal bill collections and fraudulent work-at-home schemes

They call to say your grandchild is in trouble and needs money wired right away, or to bully you into paying debts you may or may not owe. They show up at your door to promise lower electric bills, or email to say there’s a problem with your Social Security, tax return, passport, bank account or computer and you need to supply information — or wire money — to resolve the problem. They pose as travel agents, bilking your immigrant community of thousands of dollars for nonexistent plane tickets to home countries.

There seems to be no end to the schemes bad actors concoct to prey on ordinary people, and the methods they use to reach, persuade and even threaten them in order to take their hard-earned money.

A growing problem

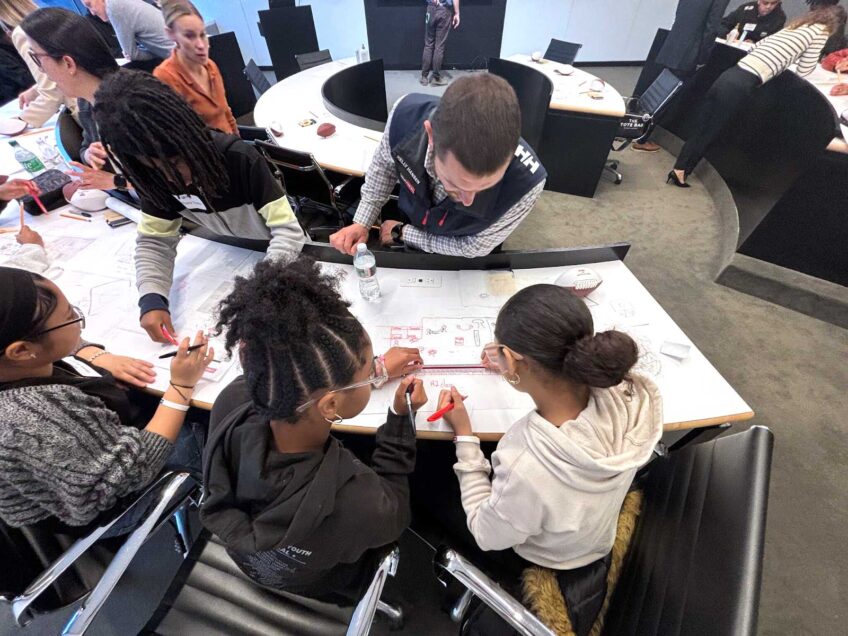

“The scope of consumer fraud in this country is massive,” said William Efron, the Federal Trade Commission’s northeast regional director, in a July 26 press briefing hosted by the FTC and the Massachusetts Attorney General’s Office, held at the National Consumer Law Center (NCLC) in Boston.

Efron laid out numbers showing the problem’s scope and nature: In 2017 alone, the FTC received nearly 2.7 million complaints, with the top three categories being debt collection, identity theft and imposter scams.

“And these are just based on the reports we’ve received,” he added. “We know that much more actually takes place.”

Efron described a work-at-home scheme that tricked consumers into paying an up-front registration fee of $99 to $399 to start earning money stuffing envelopes. The FTC shut down this operation, but not before tens of thousands of people signed up and paid the fees. People were promised $5,000 per week in earnings, but Efron said 90 percent received no money at all — and those who were paid earned on average less than $20.

Some scams tap into activities that are legal, but practiced in predatory and deceptive ways.

Massachusetts residents can buy electricity from competitive electric suppliers instead of the local utility company. The policy aims to drive down rates, but for many, it has done the opposite, according to NCLC Staff Attorney Jenifer Bosco.

Electric supplier representatives knock on doors, often implying they are with the utility company, checking whether you’re eligible for a cheaper rate. They ask to see an electric bill.

“Once they have the account number, they can switch people’s supplier without their consent,” Bosco said. Even when a customer does agree, it is often to a ‘teaser rate’ that balloons unexpectedly later.

People of color

The deceptive tactics are often targeted to communities of color, lower-income and immigrant communities, she said — and the losses have been substantial. A Massachusetts AGO report showed that from 2015 to 2017, Massachusetts consumers overpaid for electricity by a stunning $176.8 million.

NCLC Staff Attorney Jeremiah Battle Jr. described land installment contracts, which he said “lure people into a false sense of homeownership.”

In a land installment contract — also called an agreement for deed — a buyer agrees to make payments to the seller, often for a 30-year period, but doesn’t receive legal title to the property until all the payments are made. The buyer assumes obligations for property taxes, water bills and repair costs, which often are necessary simply to make the home habitable.

This type of contract is not new and not illegal, but an NCLC report calls it “the newest wave of predatory home lending,” as the model targets many of the same communities of color that bore the brunt of the subprime mortgage crisis.

“These contracts are built to fail,” Battle said. “There’s no appraisal, no home inspection, no title — you have all of the responsibilities, but none of the rights of home ownership. And you’re evicted like a tenant if you miss one single payment.”

Attorney Nadine Cohen of Greater Boston Legal Services listed a dizzying array of recent scams, including door-to-door vacuum cleaner sales and collection of first month’s rent and deposit for apartments not actually available.

“Don’t pay in cash,” she advised. “And never give personal information by phone or email to someone you don’t know.”

If you’re called into small claims court by debt collectors, go, said Tallulah Knopp of the Volunteer Lawyers Project. Missing a hearing means an automatic judgment against the person, even when collectors, who are often large debt-buyers, lack documentation of the true amount due. Most people are unaware that collectors cannot force you to make payments from Social Security income, or if your monthly income is less than a certain amount, she said.

VLP attorneys provide free legal advice in some courthouses on the days debt collection cases are heard. Knopp said nearly all defendants assisted by lawyers see their debt reduced or are able to negotiate a manageable payment plan.

Janice Fahey of the Massachusetts AGO said the AGO’s Consumer Advocacy and Response Division hotline receives five to 50 scam reports daily. Complaints from elders about identity theft are increasing, and for them it’s especially damaging.

“Often this was their nest egg, all the money they had,” she said.

It’s crucial to report scams, Fahey said, and one needn’t feel guilty for being victimized.

“We can all be vulnerable to a scam,” she said. “It can happen to anyone, of any age. It doesn’t discriminate.”

Resources for scam reporting and victim assistance

Federal Trade Commission

Online: ftc.gov/complaint

Phone: 1-877-FTC-HELP (1-877-382-4357), TTY 1-866-653-4261

Mass. Attorney General’s Office

Consumer Advocacy and Response Division: https://www.mass.gov/get-consumer-support

Consumer hotline (Monday-Friday 10 a.m.-4 p.m.): 617-727-8400

Elder hotline: 1-888-243-5337, TTY: (617) 727-4765

legal assistance

Volunteer Lawyers Project Eastern Region Legal Intake (ERLI) line: 617-603-1700

Online: https://www.vlpnet.org

VLP in person: Boston Municipal Court, 24 New Chardon St., Boston – Volunteer lawyers staff an advice table on the 5th floor every Wed. 9-11:30 a.m. and Thurs. 1-2 p.m.

Greater Boston Legal Services: https://www.gbls.org, 617-371-1234