David vs Goliath. Mike Tyson vs Buster Douglas. Filet mignon with ketchup.

All of these are obviously some of the greatest mismatches in history, but there may be no greater mismatch than the one between what people earn in this country and the cost of rental housing.

The most recent evidence of this came from the National Low Income Housing Coalition’s report released last month: “Out of Reach 2018: The High Cost of Housing.” Not only is there not a single place in the country where a full-time minimum-wage worker can afford a modest two-bedroom rental home at fair market rent, but Massachusetts is the sixth most expensive state in the country for renters.

In Massachusetts, the Fair Market Rent (FMR) for a two-bedroom apartment is $1,489. To afford this level of rent and utilities — without paying more than 30 percent of income on housing — a household must earn $4,964 monthly or $59,571 annually, which is an hourly wage of $28.64.

The typical family of three that participates in Metro Housing|Boston’s programs — with an average annual income of approximately $13,600 — clearly does not approach this “housing wage” level. Likewise, a head of household earning the state’s minimum wage of $11 would have to work 104 hours per week or 2.6 full time jobs to afford a decent two-bedroom apartment.

Across Massachusetts, there is a significant shortage of rental homes affordable and available to households who have extremely low incomes. Many of these families are severely cost burdened, spending more than half of their income on housing, making them more likely than other renters to sacrifice other necessities like healthy food and healthcare to pay the rent.

In many ways, state and local policy makers in Massachusetts are responding well to these realities, but more can be done. Metro Housing will continue to do its part to make sure that increased development of housing for the lowest income renters does not waver.

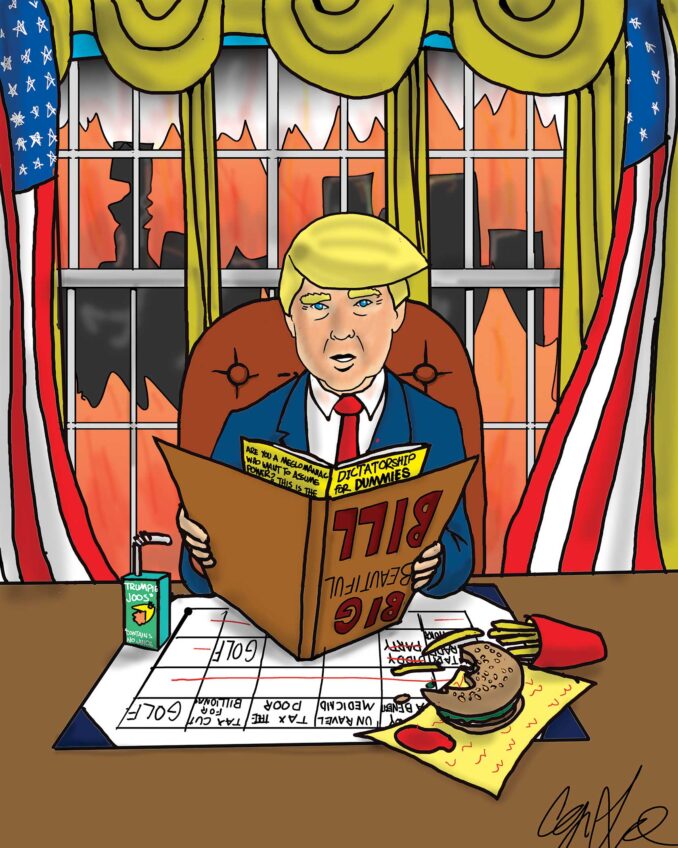

National policy, however, is another story. The Trump administration and the Department of Housing and Urban Development’s proposals to slash investments in affordable housing, raise rents and impose rigid work requirements on low income families, will only increase housing poverty and homelessness in America.

For households living paycheck-to-paycheck, an average rent increase of $117 a month proposed by the administration would mean less money for groceries, medications, childcare, and other basic needs, let alone investments in their futures. The lack of stable, affordable housing can result in the loss of employment, affect health outcomes and academic achievement, increase evictions, and lead to homelessness, which we know to already be a problem in Massachusetts.

This region, like the rest of the country, is facing a critical challenge. To meet this challenge and to avoid becoming another historical mismatch, it is imperative that we invest more in critical programs that serve as a safety net for the lowest income households. We must increase investments in affordable housing solutions like Housing Choice Vouchers, the national Housing Trust Fund, and project-based rental assistance to address the shortage of affordable rental homes in America.

Christopher Norris is executive director of Metro Housing|Boston.