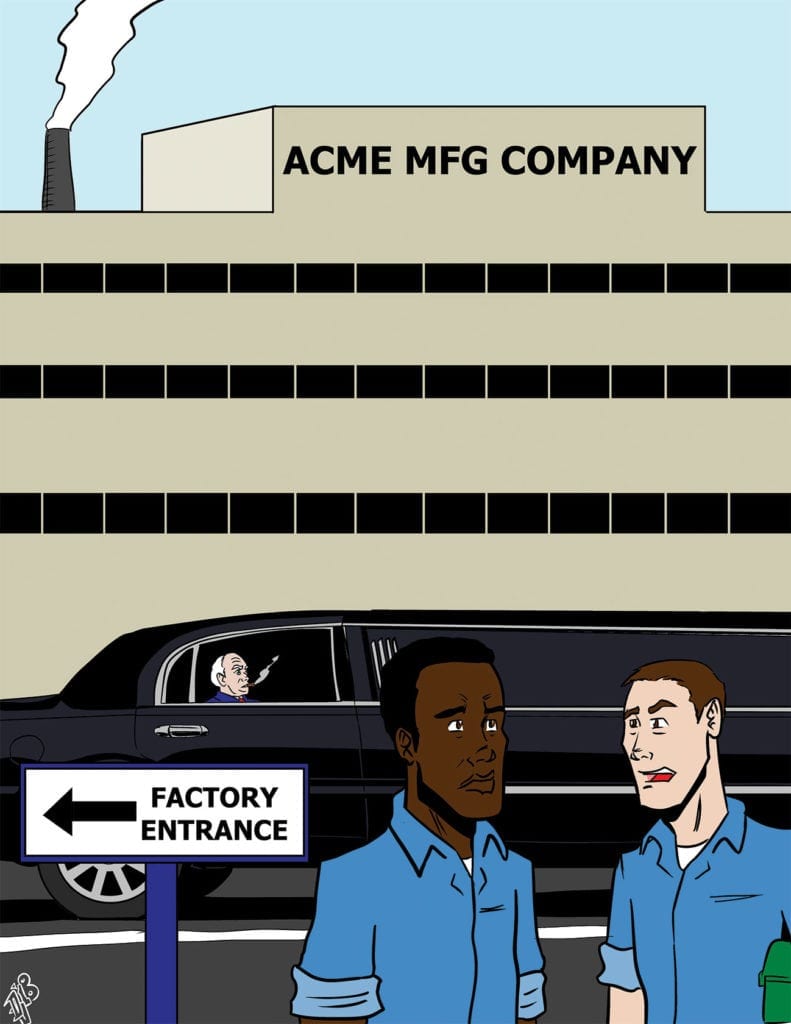

Unemployment is no longer a problem for most Americans. With an unemployment rate of 3.9 percent, jobs are generally available. The problem is that wages have not increased substantially from 1972 while the cost of living has gone up. Recent reports indicate a widening gap between pay for CEOs and the pay of the ordinary worker. The excessive salaries of some CEOs contribute to the nation’s concern for income disparity.

The Securities and Exchange Commission, which governs the required reporting of publicly traded companies, now insists that those firms publish the median salary levels of workers as well as the compensation to managers. According to a report in the Boston Globe, the range can be quite wide. For example, the CEO of Vertex Pharmaceuticals was paid $17.2 million in 2017, but that was only 81 times the company’s $211,511 median, the average salary for half of Vertex employees. At TripAdvisor, median salary was $99,643 and the CEO earned 481 times that amount.

The nature of companies differs substantially from industry to industry so it is difficult to assert that one salary standard fits all. Nonetheless, it is worthwhile to determine how the pattern of extraordinarily high executive salaries developed. Some salaries seem exorbitant, even though the CEO is highly skilled.

The late A.A. Berle, a law professor at Columbia University, and a former U.S. diplomat and member of President Franklin Roosevelt’s brain trust, developed a theory he identified as “power without property.” He observed that the original industrial giants owned their companies and developed their wealth from dividends resulting from the companies’ profits. The business model required that expenses, including management salaries, be minimized in order to maximize profits and dividends.

When the company founders retired, and stock ownership became more diverse, professional managers were recruited to run the companies. Since they owned little of the stock and could not generate personal wealth from dividends, the only alternative for the professional managers was to assess substantial salaries.

The higher business executive salaries then began to influence the professional level pay scales in higher education, non-profit companies and government agencies. As might be expected, more people with higher income put upward pressure on prices. Inflation made regular workers feel like they had suffered a cut in pay.

Prices have been rising faster than wages. In 1956 the minimum wage was $1 per hour and the consumer price index was $27.20, but in 2018 the federal minimum wage is only $7.25 per hour and the CPI is now $250.46. Some states have passed laws to raise the minimum wage in their state, but protesters are pushing for a $15.00 per hour rate across the country.

There has been a general deterioration in the standard of living. Politicians campaign about the loss of the middle class. But there are no proposals on the horizon to curtail the unfettered upward drive in the cost of living.