It was 50 years ago that the predecessor of OneUnited Bank, Unity Bank and Trust Company, was founded in Roxbury, Massachusetts. That same year, the Rev. Dr. Martin Luther King, in his final speech, delivered in Memphis, Tennessee, spoke of the imperative of investing in black institutions, including black-owned banks:

“…we’ve got to strengthen black institutions. I call upon you to take your money out of the banks downtown and deposit your money in Tri-State Bank. We want a ‘bank-in’ movement in Memphis.”

Today, OneUnited has grown to become the largest black-owned bank and first black internet bank in the country. Tri-State Bank has also grown over the years as it continues to serve the black community of Greater Memphis. And Mechanic & Farmers of North Carolina, the oldest black bank, is celebrating its 111th anniversary. In honor of the late Dr. King, and his legacy and visionary leadership, we reflect on his call for a “bank-in” movement as we are inspired by the activism of millennials and the #BankBlack movement.

When Unity Bank was founded in 1968, there were 14,000 commercial banks in the U.S., of which only 20 were black-controlled. Established to give equal economic opportunity to the black residents of Roxbury and Dorchester, Massachusetts, Unity Bank embarked on this journey with the slogan, “The Bank with a Purpose!” It provided free seminars on consumer education, investments, credit and how banking works.

Unity Bank was conceived by John T. Hayden, a black graduate of Harvard Business School and organized by the late Donald E. Sneed, Chairman and President, Marvin E. Gilmore, Vice President, and C. Bernard Fulp, Assistant Vice President and Chief Loan Officer. Fulp, who previously worked at two large banks in Boston and saw firsthand the discriminatory policies of banks including redlining, stated, “Place of residency is given more weight than any other factor when commercial banks grant loans. Slum residents are eliminated solely on the basis of where they live. This drives those who can least afford it to finance companies and loan sharks who charge unreasonable interest.” Unity Bank was founded to change all of that.

Although progress has been slow, there continues to be hope and opportunity inspired by the #BankBlack and #BuyBlack movements and supported by the internet and advancements in technology. The black community has begun to focus on Dr. King’s economic message by recognizing the power of its $1.2 trillion in annual spending to build generational wealth. Black banks and credit unions are proud to be at the forefront of this burgeoning understanding of the power of “collective economics.”

Nearly 50 years later, OneUnited Bank continues the legacy of Unity Bank, including its mission to be “The Bank with a Purpose.” OneUnited became the first black interstate bank, expanding beyond Boston by acquiring banks in Miami and Los Angeles. The bank received a designation as a Community Development Financial Institution (CDFI) by the U.S. Department of Treasury and loaned over $2 billion to communities that are over 70 percent or more minority and low to moderate income, including Roxbury, Dorchester, Liberty City, South Central and Compton.

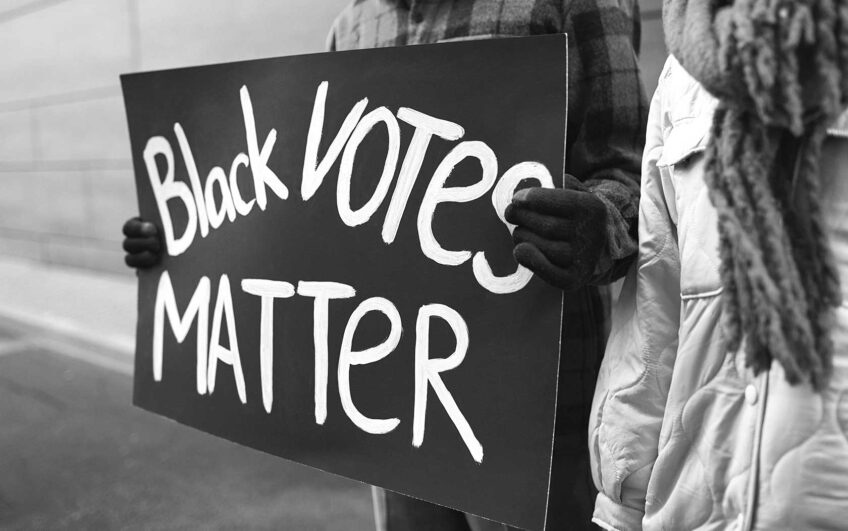

The bank launched an internet bank in 2005 with mobile banking and 25,000 surcharge-free ATMs and built an exciting online community through social media. OneUnited Bank is “unapologetically black.” The bank continues to focus on financial literacy and, importantly, advocates for economic and social justice including supporting #BlackLivesMatter.

After 50 years, the legacy of Dr. Martin Luther King Jr. lives on through the legacy of Unity Bank and Trust, the current work of OneUnited Bank and all black banks. We are honored to carry the torch … and recognize the importance of passing the baton from “bank in” to #BankBlack.

Teri Williams is chief operating officer of OneUnited Bank.