Biz forum highlights solutions

Speakers tout success models for easing Hub economic inequality

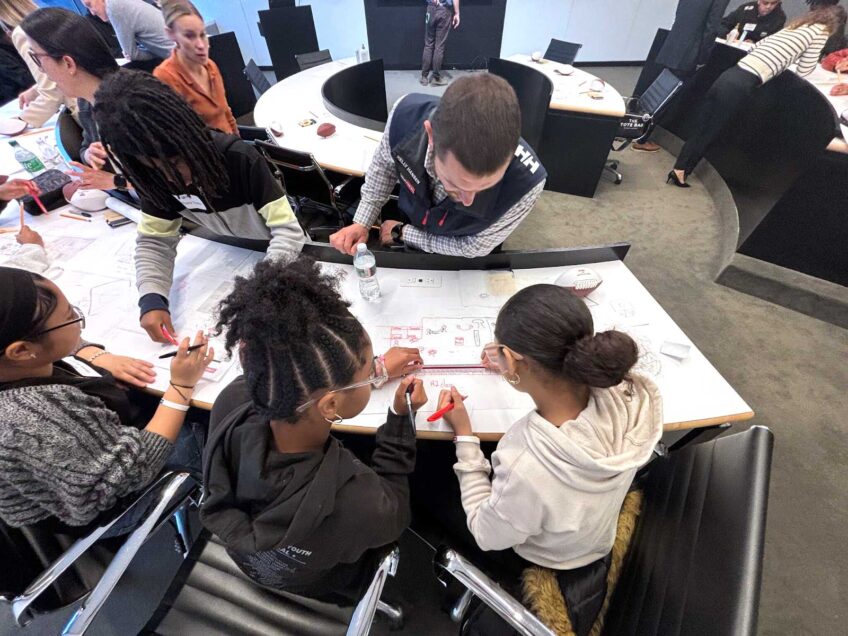

An audience of some 350 people gathered Monday night at the Federal Reserve Bank in Boston for a discussion of solutions to racial and economic inequalities in Massachusetts. The event, organized by the Black Economic Council of Massachusetts, brought together political, government and business experts. In short presentations, a slate of speakers described successful models that help minority-owned business enterprises thrive and grow.

Author: Sandra LarsonBob Rivers, Chairman and CEO of Eastern Bank, spoke about successful programs to support greater capacity, capital and revenue for black- and Latino-owned businesses.

Author: Sandra LarsonBECMA co-founder Darryl Settles (center) and other attendees conversed after the Feb. 26 forum at the Federal Reserve Bank of Boston.

On the web

Black Economic Council of Massachusetts (BECMA): www.becma.org

“The Color of Wealth” report: www.bostonfed.org/publications/one-time-pubs/color-of-wealth.aspx

The impetus for the discussion was the Boston Globe’s recent Spotlight series examining the state of racism in Boston, which laid bare some of the ways that blacks in Boston have been left out of the city’s thriving economy, as well as the 2015 Federal Reserve Bank of Boston report, “The Color of Wealth in Boston,” which revealed massive racial disparities in income and wealth between white households and black and Latino households.

At the Feb. 26 event, Federal Reserve Bank Senior Community Development Analyst Marija Bingulac reviewed key findings of that 2015 report.

“The disparities are huge,” she said. While the revealed income gaps were sobering, it was the gap in wealth that emerged as a shocking truth: while the median net worth of white households in Boston is $247,500, for black households it is only $8. Lack of accumulated wealth makes it difficult or impossible to invest in education, make a down payment on a house, amass enough capital to start a business and withstand unexpected expenses like large medical bills.

At-large City Councilor Ayanna Pressley, in her turn at the lectern noted that the surest way to end poverty is to ensure opportunities to build and maintain wealth — particularly through home ownership and business ownership.

The policy example Pressley presented was the recently-passed city ordinance she authored with At-Large Councilor Michelle Wu promoting equity in city of Boston contracts. The ordinance aims to increase contract opportunities for minority- and women-owned business enterprises (M/WBE) by such measures as creating a supplier diversity program and instituting a quarterly reporting requirement to measure progress.

Karilyn Crockett, the city’s director of economic policy and research, gave further details about how the city promotes equity in its procurement and contracting processes, highlighting the city’s outreach, assistance and direction of procurement dollars to small and local businesses and M/WBEs and the city’s willingness to be held accountable for these efforts.

Bob Rivers, chairman and CEO of Eastern Bank, described a constellation of programs that the bank has helped launch to support greater capacity, capital and revenue for small, and especially, black- and Latino-owned businesses: the Business Equity Initiative; the Growth Fund with the Boston Foundation; and the Pacesetter Initiative with the Greater Boston Chamber of Commerce.

Kenn Turner, director of diversity and inclusion at Massport, described his agency’s ambitious effort to make diversity and inclusion an integral part of its entire business process. He highlighted the innovative bid process for a $550 million hotel project on land it owns in the Seaport District. Massport’s request for proposals for that project established minority participation as one of four factors in review and selection of design and construction firms.

“We trashed the existing [diversity] paradigm, took a blank slate and started over. You cannot do that without vision, courage and political will,” Turner said, drawing applause.

Peter Hurst, president and CEO of the Greater New England Minority Supplier Diversity Council (GNEMSDC), spoke of a pathway to closing the wealth gap through minority business ownership. He stressed the need for greater equity capital as the “fuel” for real growth and called for greater involvement of the private sector. He also urged MBEs to do business with other successful MBEs to increase revenue.

Diversity programs in the construction industry typically are focused on subcontractor hiring — after the general contractor has already been selected, said Greg Janey, President and CEO of Janey construction, in a co-presentation with John Moriarty of John Moriarty & Associates. The two, whose joint venture won the Massport hotel general contractor bid, presented a model of partnership between white- and black-owned firms that’s proven successful in building minority-owned firms’ experience to the point where they can break through the “glass ceiling” to win larger projects.

After the event, as attendees and presenters mingled and chatted, Ed Gaskin, executive director of Greater Grove Hall Main Streets, said he appreciates BECMA’s effort to present solutions. He said he hopes the conversation continues to move along from getting a fair share of procurement dollars from the public and private sectors to a larger strategy that emphasizes other forms of entrepreneurship as well, including high tech and black-owned private equity firms.

Restaurateur and real estate developer Darryl Settles, BECMA co-founder and one of the key organizers of Monday’s event, said the purpose of the forum was to go beyond discussion of the Globe’s racism series and publicize what’s actually working.

“We wanted to highlight the positive impact that’s being made. I know there are examples out there that are already working, and people don’t know about them,” he told the Banner in a phone interview the day after the event. “I heard from many people last night, ‘Great information — I didn’t know this.’”

At any given gathering, he noted, “There could be a visionary like John Moriarty or Bob Rivers in the audience, and this sort of event could get them motivated to act — so these types of events are very important.”