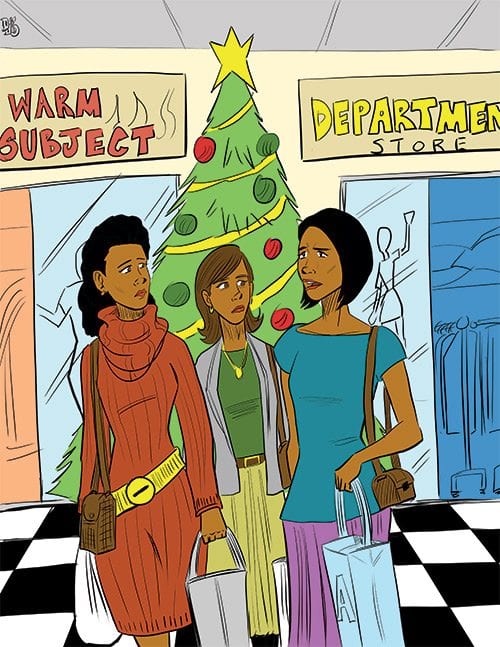

There is an old expression that seems to be going the way of high button shoes. Shoppers once believed that you get what you pay for. This was an assertion that a respected brand name would provide greater quality. Sometimes you might pay a little more but you then have confidence in the value of your new purchase. There always seemed to be greater risk in shopping in small stores or for products that have not established their brand.

With heavy Christmas shopping under way, it appears that the public is no longer protected by relying on quality brands. A common scam in retail stores is to make shoppers believe that items are on sale, when the advertised price is actually what is consistently offered. Complaints have been filed against Sears and Kohl’s for resorting to this deception. According to reports, lawsuits have been filed for these alleged violations of the Federal Trade Commission rules.

Yet those offenses are trivial compared with the deceptions in some financial institutions. Depositors in Wells Fargo banks have been unknowingly signed up for financial services that they do not need or use. Nonetheless, the required fee is deducted from their deposit balances every month. Now it appears that there is also a surreptitious arrangement with Prudential Insurance Co. to have Wells Fargo depositors unknowingly buy an unwanted policy.

The shopper in a retail store who buys falsely priced merchandise at least walks away with a worthwhile acquisition. He or she might have paid too much for the purchase, but at least the shopper has something of value. The scammed Wells Fargo depositor has only a declining bank balance with no benefits.

There is a strong sense that American culture is becoming increasingly more predatory, a proposition that is at odds with the spirit of Christmas.