Consumers have been deceived by vendors since time immemorial. Before industrialization, buyers had to be watchful of shopkeepers who might put a heavy thumb on the scale. When the economy became more sophisticated, vendors often tried to sell defective goods. Caveat emptor is a phrase developed in the law to place the burden of assessing product quality on the buyer. But now the appeal of riches from private enterprise has developed a common sense of greed that has created a predatory culture in America.

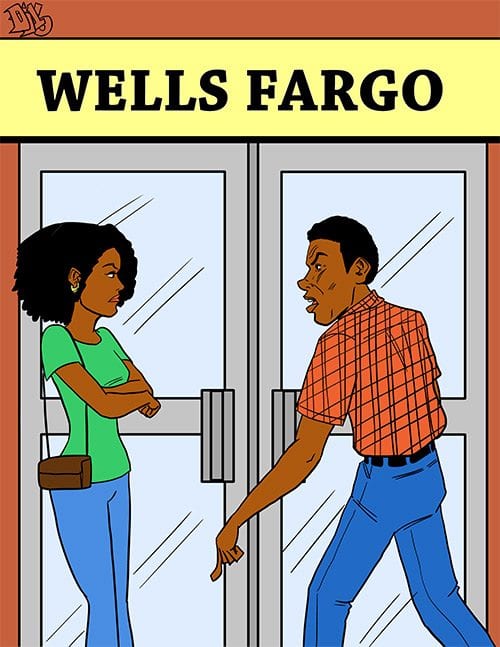

Banks were once considered to be the safest place to secure one’s funds. A major purpose of banks has always been to serve as the safest depository, but now that assurance has been breached. The Wells Fargo Bank has fired 5,300 employees for enrolling depositors in additional accounts without their knowledge and then charging them a reported $1.5 million or more in fees. The issue now confronting the country is whether criminal indictments are to be filed against the bank executives who benefitted from bonuses earned from the fraud but were not directly involved in the scam.

The bank employees who opened bogus accounts for their customers did so to keep their jobs by generating additional revenue through selling bank services. Those who were not successful at cross-selling were fired. With 5,300 employees being fired, higher level executives must have been aware of problems with the bank policy. Tellers and clerks did the dirty work but they were sent on their criminal path by the executives.

No top bankers were jailed for the excesses that led to the 2008 bank collapse. They should not be able to evade the scrutiny of the law this time.

Fortunately, bank customers who were defrauded will be able to be reimbursed. That is not always the result for victims of the Ponzi scheme. In 1920, Charles Ponzi became a prominent Boston investment adviser by promising extraordinary dividends to customers. The only problem was that there were no investments. Ponzi simply paid early customers from the funds invested by later clients. This strategy was perfected by Bernie Madoff, who took about $50 billion from unsuspecting investors.

Many of the Ponzi scheme investors are fairly well off. They have to be in order to have the funds to invest. Madoff’s victims included Larry King, Steven Spielberg and Jeffrey Katzenberg, all of whom were still wealthy after the scam. However, there is an especially vicious fraud that ensnares those with limited financial resources and leaves them in a financially impaired condition from which they might never recover.

A similar sad story exists in the educational sector. The technological changes in the economy have induced many Americans to become re-educated in order to qualify for the jobs that have become available. A number of for-profit companies have been created to fill the need. However, unlike the traditional non-profit colleges and professional schools, some of the for-profits have shown greater interest in collecting tuition than in determining whether enrollment in the program is beneficial to the students.

The Department of Education has denied federal tuition assistance to schools that do not produce good academic and employment results for students. When Pell Grants were denied last year, Corinthian Colleges was forced to close 28 schools with 16,000 students. Recently ITT Educational Services, a major for-profit school system with 35,000 students was forced to declare bankruptcy for the same reason.

Vicious predators have an easy target with ambitious Americans who want to realize the American Dream. It is important to learn that hard work, planning and self-discipline are the values that pave the road to success. Only a fortunate inheritance can shortcut the journey. Even then, beware the predators.