Members of housing rights groups gathered at 49 Speedwell St. in Dorchester to protest mortgage holder Fannie Mae’s policy of evicting tenants and former owners from homes following foreclosure.

A coalition of Boston housing activists is calling on the federally-funded housing giant Fannie Mae to end foreclosure policies they say are destabilizing Boston neighborhoods and driving up the cost of housing.

And with the appointment this month of Melvin Watt as head of the Federal Housing Finance Agency, coalition members are hoping they now actually have a chance of effecting change.

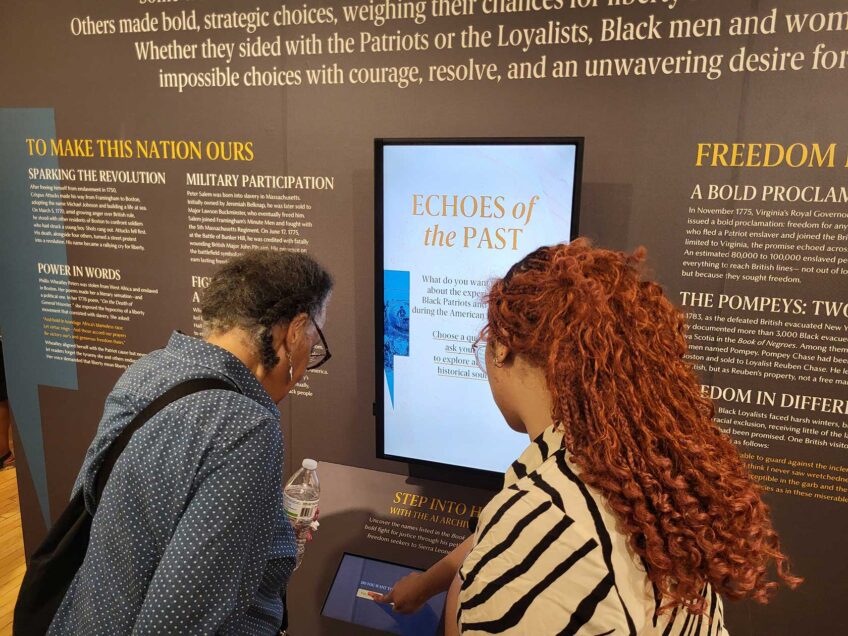

As Watt completed his first week on the job, taking over from Bush appointee Edward DeMarco, members of City Life Vida Urbana, the Right to the City Coalition, the Greater Four Corners Action Coalition and other groups demonstrated at a foreclosed Dorchester property against the firm’s refusal to negotiate a sale to a nonprofit group while the former owner, Domingo Franco, is still living on the premises.

Maureen Flynn, coordinator of the Coalition for Occupied Homes in Foreclosure, says her group has tried unsuccessfully to negotiate with Fannie Mae over the Speedwell Street property and others in the Dorchester area.

“Fannie Mae is one of the biggest owners of foreclosed properties and we’re having the greatest difficulty with them,” she said.

COHIF is a coalition of nonprofits and city agencies working on a pilot project to keep owners and tenants in their homes. Their aims run counter to Fannie Mae policy.

“Fannie Mae’s goal is to empty out buildings and sell them,” Flynn says. “It’s the opposite of our goal.”

Asked for comment, Fannie Mae spokeswoman Callie Dosberg sent the Banner a statement via email.

“Tenants under a bona fide lease or tenancy who rent a property that goes into foreclosure have the opportunity to continue renting the property from Fannie Mae,” the statement reads. “Former homeowners who are foreclosed upon must vacate the property unless they are able to satisfy the full debt of the foreclosed mortgage, including interest and the costs of pursuing the foreclosure.”

Franco’s tenant, Josephina Luna, says she never received notice that Fannie Mae was taking possession of her home, but she did receive a notice requiring her to vacate the building.

City Life staff, who are working with the Franco, say it’s in the best interest of owners, tenants and neighbors keep the owners in their homes.

“If the banks force people out of their homes what you’ll have is an abandoned building, sometimes four or five on a block, which brings the values of everyone’s home down,” says City Life/Vida Urbana organizer Antonio Ennis.

When homes go into foreclosure, banks commonly send owners and tenants letters telling them to vacate in 14 days.

“We encourage people to stay in their homes because the bank doesn’t have the authority to evict tenants,” Ennis says. “The banks engaged in predatory practices. We encourage them to stay in place so they can have more leverage.”

Franco obtained a mortgage for the Speedwell Street triple decker from JPMorgan Chase in August 2002, purchasing the house for $430,000. In 2009, he lost his job as a union carpenter and squeaked by with payments before going into default.

“I called Chase to ask for a loan modification,” he said. “I was paying my mortgage with a credit card.”

Franco said he applied for a modifications six times, and updated his application for the modification many more times, as directed by Chase.

“They denied all my requests to do a loan modification,” he said.

The bank foreclosed in August 2013, “11 years and one day after I bought the house,” Franco notes.

He and Luna have remained in the house, while Flynn continues to attempt negotiations with Fannie Mae on behalf of COHIF.

While Boston housing advocates cite Fannie Mae as a bad actor in neighborhoods that have been hit hard by foreclosures, the agency was founded as an attempt to make homeownership more attainable. Under the Administration of President Franklin Delano Roosevelt, the Federal National Mortgage Association was incorporated as a New Deal initiative aimed at creating a secondary market for mortgages. By purchasing federally insured home loans from banks, Fannie Mae enabled the banks to reinvest their assets and make more loans, thereby expanding home buying opportunities during the Depression era.

Although Fannie Mae is not a government agency, the federal government owns a majority interest in the now publicly traded company.

Following the mortgage crisis of 2007 — which was precipitated largely by investment bankers buying and selling mortgaged-backed securities from unregulated conduits — the federal government used public funding for a $71 billion bailout of Fannie Mae, which the mortgage giant has since paid back.

In some ways, the principal reduction Franco, COHIF and Right to the City Coalition members are now asking of Fannie Mae is the holy grail of community groups in high-foreclosure neighborhoods like Dorchester. But as common sense as it sounds to community groups, agreeing to write down the principle on a mortgage that exceeds the fair market value of a home is a non-starter for the banking industry.

Even though Franco’s mortgage originator, JPMorgan Chase, was part of a $25 billion mortgage settlement reached last year with 49 attorneys general to settle claims of mortgage fraud — a settlement that required that 30 percent of the settlement amount go toward principal reduction — JP Morgan and the other banks have only dedicated 14 percent of the $25 billion to writing down mortgages in the first nine months of the settlement.

While many states are relying on lawsuits and settlements with unscrupulous lenders to help save borrowers with underwater mortgages, some communities are taking things a step further. The city of Richmond, Calif., last year approved a measure to take homes with underwater mortgages from banks by eminent domain, paying the banks a fair market value for the properties. That measure has drawn fire from the banking industry and the Obama administration.

Wall Street investment firms and banks created the Securities Industry and Financial Markets Association to lobby Congress to block Richmond and other cities from using eminent domain to buy mortgages.

The financial institutions also threatened to stop issuing new mortgages in Richmond if the town follows through on its plan.

Back in Dorchester, the battle for principal reduction is quieter, but Fannie Mae’s heels are dug in.

“We want to work with any borrower who is struggling, and our goal is to prevent foreclosure whenever we can,” Fannie Mae’s Dobson says in her statement. “As the Federal Housing Finance Agency announced in 2012, principal reduction is not an option that Fannie Mae is able to offer.”

On August 21 of last year, Fannie Mae attempted to auction off 49 Speedwell St., setting the opening bid at $337,000. Flynn said the Coalition for Occupied Homes in Foreclosure could not have afforded to purchase the building at Fannie Mae’s bid prices, considering the work needed to bring the building up to code and the rent Franco’s tenant can afford.

“We don’t evict anyone living in a property hoping to get higher rent from the next tenant,” Flynn said.

Investors who attended the auction may have reached a similar conclusion. None bid on the property.

Franco says he hopes new Federal Housing Finance head Watt will change Fannie Mae’s policies and allow him to stay in his home.

“I do not want to live in this house for free,” Franco says. “That never has been my intention. I understand that everyone who makes an investment wants to have a return. I want to ask Mel Watt for the opportunity to buy this house. Or rent it from COHIF.”