GOP mute on Apple and other corporations’ welfare grabs

The news that Apple paid zero taxes on tens of billions in income on its overseas operations, investments and sales grabbed a momentary headline but stirred little more than a yawn among GOP leaders. There’s little surprise here for several well-known and deeply troubling reasons. The tax dodge scheme that Apple and other giant corporations and banking entities use to pay zero or minimum taxes on their sales and investments abroad is perfectly legal. Tax laws allow companies that do business outside the U.S. to park their profits — that’s cash — in offshore accounts, and they are exempt from taxing as long as they stay there. Indeed, Apple CEO Tim Cook said as much in explaining how Apple makes billions abroad and pays no taxes on it. The fallback retort of Apple and other corporate tax dodgers is that they pay billions in U.S. taxes on their operations here, so there’s no issue.

This is a ridiculous argument. Apple and other companies are American-owned and operated firms, and worse, they pay little or no taxes in the countries where they sell their products. Apple’s main subsidiary, a holding company that includes Apple’s retail stores throughout Europe, hasn’t paid any corporate income tax in the last five years.

Apple’s tax dodge again tossed the ugly glare on the cozy but toxic corporate welfare feed at the government trough. Six years ago, the libertarian Cato Institute documented nearly $100 billion in direct and indirect subsidies that the banking industry and major corporations grabbed from the federal government. This figure doesn’t include the billions more in direct and indirect subsidies from state and local governments. This figure almost certainly is even higher today.

The federal agencies that shell out the corporate welfare largess are unchanged. The Tax Foundation in a 2010 report found that corporations will receive more than $600 billion in government entitlements spread over the next five years in the form of an array of tax breaks and loopholes. The partial checklist of those breaks include: the Graduated Corporate Income Credit, Inventory Property Sales, Research and Experimentation Tax Credit, Deferred Taxes for Financial, Firms on Certain Income Earned Overseas, Alcohol Fuel Credit, Credit for Low-Income Housing Investments, Accelerated Depreciation of Machinery and Equipment, the Deduction for Domestic Manufacturing, Exclusion of Interest on State and Local Bonds and Deferral of Income from Controlled Foreign Corporations. Every major corporation and bank is and has been in on the subsidy grab for years.

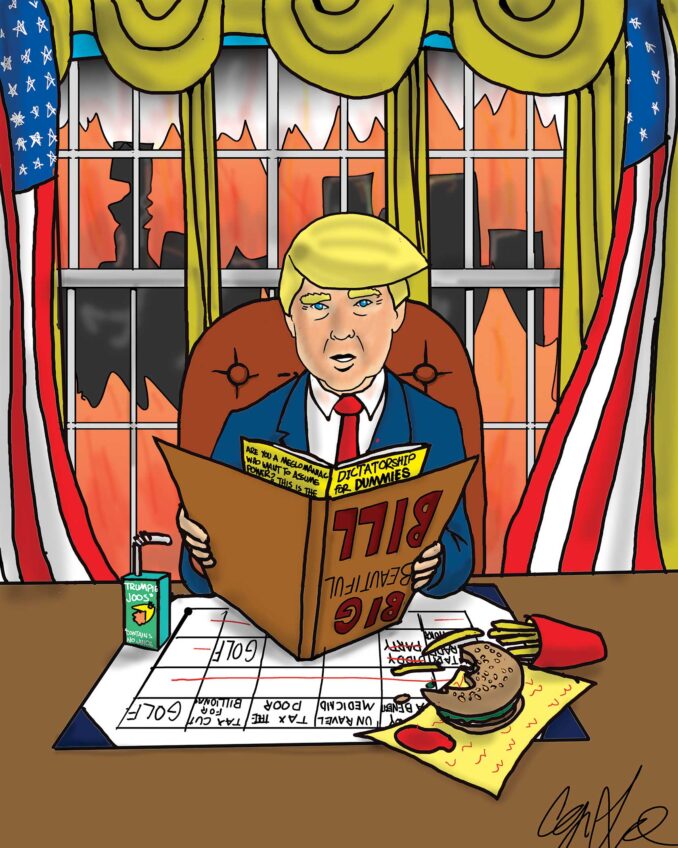

The billions doled out in corporate welfare annually dwarf the amount the federal government pays out to the states for welfare, food stamps, child nutrition programs and other support programs for the poor and needy. However, these are the programs that are eternally in the GOP’s bullseye to be cut or eliminated. They are convenient, popular and emotionally rousing programs that stir the ire of millions and routinely ignite rants against welfare queens, leeches and the entitlement chislers. To brand a corporate or banking head that receives millions in direct or indirect government handouts lazy and slothful is unthinkable. The GOP has appropriated the stereotype of a “government leech” into the perennial political attack point that the government is too big, wasteful and intrusive. And that those who appear to benefit most from government should pay the most for it.

The GOP’s big, wasteful, intrusive government line spans nearly a century of GOP politics. It has been used as a political ram to batter Democratic presidents. It was used against FDR’s New Deal, Truman’s Fair Deal Program — which included a push for national health care — LBJ’s Great Society jobs and education spending programs, and to pressure JFK and Clinton into tax cuts that directly benefited corporations and the wealthy.

This ties precisely into the GOP’s other sacred belief that lower-end workers and the poor are in essence parasites that feed at the government pen at the expense of upper-income earners and the wealthy.

The GOP has translated its mantra of chopping off the subsidies from the supposedly undeserving needy — but not touching a dime of the federal government’s subsidies to the truly undeserving corporate rich — to rally conservatives, the business community and a significant number of Americans who genuinely believe government spending and power is way out of control. And of course, to wage its relentless, high-intensity war against President Obama.

To his credit, Arizona Sen. John McCain did rip Apple for tax avoidance. But if past practice is any indication, aside from a few nasty media hits and feigned indignation, that will be where it ends. And Apple and the other corporate biggies will skip away with their corporate welfare goodies just as they always have.

Earl Ofari Hutchinson is an author and political analyst.