Black wealth gap continues to grow

For many years, a major policy concern has been the problem of poverty in the United States. President Lyndon Johnson even declared war on poverty. Everyone would agree that the federal standard of an annual income of $23,050 for a family of four is inadequate and such a family would be poor.

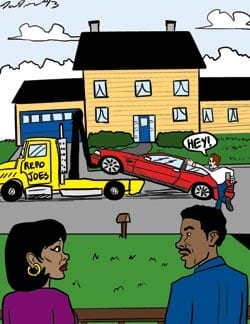

While there is still concern about the poverty of blacks, the issue of the racial wealth gap also generates considerable attention today. This gap has grown, even with the emergence of the black middle class. According to a 25-year analysis by Brandeis University’s Institute for Assets and Social Policy (IASP), the gap has increased for families in their study by $152,000 between 1984 and 2009.

Some analysts may have expected just the opposite result. There is no question that racial discrimination and segregation denied economic opportunities to blacks. However, the federal Civil Rights Act of 1964 ended the legality of racial discrimination in employment, education and places of public accommodation. Nonetheless, 20 years later in 1984, the wealth gap was $152,000 less than it was 45 years later in 2009.

Net worth is the difference between the value of what a family owns and what the family owes. For example, if the family home could be sold for $350,000 and there is an outstanding mortgage for $200,000, then the net worth of that real estate is $150,000. The IASP followed 1,700 households for 25 years to analyze the economic consequences of decisions made by the families as well as the impact of unforeseen circumstances.

In 1984, the median net worth of black families was $5,781 compared with $90,851 for white households. The wealth gap then was $85,070. By 2009, the average net worth of the black families had grown to $28,500 while the white’s net worth had blossomed to $265,000. The wealth gap had nearly tripled from $85,070 to $236,500.

A statistical survey by Pew Research of the black wealth gap in 2009 came to a different result. The median wealth of white households was $113,149 compared with $5,677 for black families. White wealth was almost 20 times greater. The results of the two studies differed substantially because of the differences in their design.

The objective of the IASP study is to follow a group of white families and a group of black families over 25 years to identify the factors that might cause a difference in the wealth of the same set of families. Prior studies of families have been able to identify factors affecting their financial well-being, but the IASP study was actually able to assess the comparative impact of various factors on white and black families.

It comes as no surprise that the number of years of homeownership is a significant factor, but the IASP study determined that it accounts for 27 percent of the wealth gap. While it might be expected that whites would have an income advantage from better paying employment, the study found that every $1 increase in income contributes to $5.19 in wealth growth for whites but only $0.69 for blacks. That is because whites, with a 20 percent income advantage, can invest in retirement plans while blacks pay off outstanding obligations.

The higher rate of unemployment for blacks accounts for 9 percent of the net worth difference. College education and family financial support each account for 5 percent.

The IASP was unable to elaborate on 34 percent of the causes for the wealth gap, but the study authors believe that the identified 66 percent will aid remedial policy decisions.

The balance sheet for the black wealth gap will help to develop policies to ameliorate the problem of wealth and income inequality in America. It is as important to develop black wealth as it is to eliminate poverty.