President Obama has heard every argument from the GOP, a gaggle of conservative economists and financial analysts on why it’s foolhardy to press for a tax hike on the wealthy. They say the hike won’t come close to raising the revenue needed to avert the fiscal cliff. They further argue that the hike would stunt business growth and drive the economy into another recession. And if those reasons weren’t enough, they assert that the wealthy already pay more than their fair of taxes while millions of Americans on the bottom income rung pay nothing.

These arguments serve only to hopelessly poison the political well and insure virtual warfare with the GOP on other legislative initiatives.

Countless studies and political history show this to be a toxic mix of economic falsehoods and political bluster. The Bush tax cuts were in effect during every minute of Obama’s first term. Yet for every month except one in his first term, unemployment never dipped below the breaking point of 8 percent.

Meanwhile, corporations and financial industry magnates hoarded tens of billions of cash. Their stockpiled cash total now stands at a near-record $1.7 trillion. This could have bankrolled thousands of small- and medium-sized businesses, expanded production and sales, created thousands of new jobs and generated millions in tax revenues. This would have been the major boost that rejuvenated the economy.

In truth, Obama’s relatively modest hikes on the wealthy violate two premises that the GOP has based much of its political existence on. One is that government is too big, wasteful and intrusive. The other is that those who appear to benefit most from government should pay the most for it.

The wasteful-intrusive-government line spans nearly a century of GOP politics. It has been used as a political ram to batter Democratic presidents. It was used against FDR’s New Deal, Truman’s Fair Deal Program that included a push for national health care, LBJ’s Great Society jobs and education spending programs, and to pressure JFK and Clinton into tax cuts that directly benefited corporations and the wealthy.

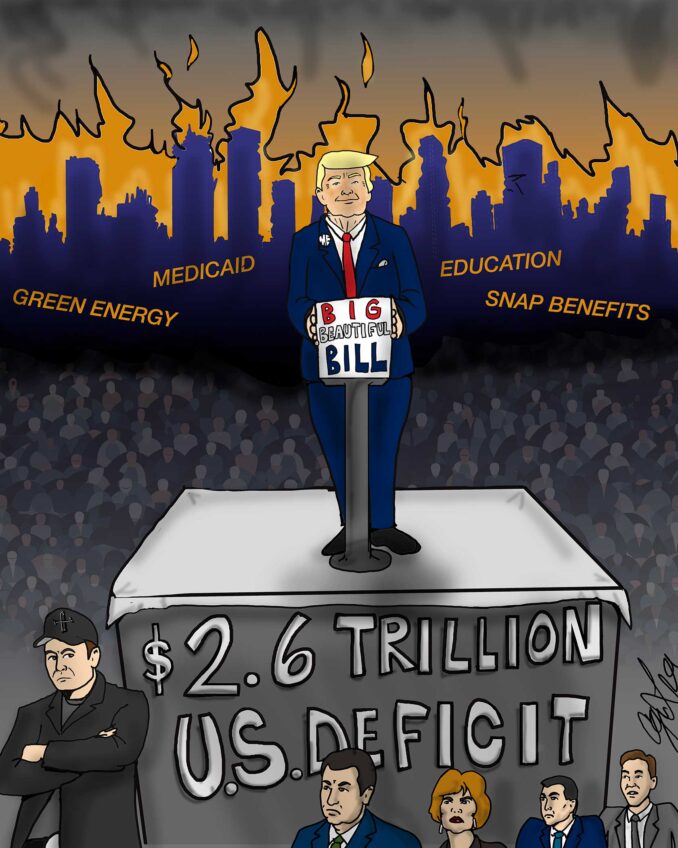

The real aim in the GOP’s mania to shield the rich from higher taxes is to further bulk up the private sector and radically chop down government. Taxes have always been its convenient and crowd-pleasing weapon to accomplish that.

This tracks directly to the GOP’s other sacred belief that the lower-end workers and the poor are in essence leeches that feed at the government trough at the expense of upper-income earners and the wealthy. This is just as bogus. A study by the nonprofit Annie E. Casey Foundation and the Corporation for Enterprise Development found that the top 5 percent of taxpayers got the overwhelming lion’s share of the nearly $400 billion that the federal government spent on tax breaks and other wealth building strategies in 2009.

The major corporations have fared even better. The Tax Foundation in a 2010 report found that corporations will be showered with more than $600 billion in government entitlements spread over the next five years in the form of an array of tax breaks and loopholes. The partial checklist of those breaks include Graduated Corporate Income Credit, Inventory Property Sales, Research and Experimentation Tax Credit, Deferred Taxes for Financial, Firms on Certain Income Earned Overseas, Alcohol Fuel Credit, Credit for Low-Income Housing Investments, Accelerated Depreciation of Machinery and Equipment, the Deduction for Domestic Manufacturing, Exclusion of Interest on State and Local Bonds and Deferral of Income from Controlled Foreign Corporations.

How much of the tens of billions they’ll receive from these government entitlements will actually go toward business expansion and job creation is subject to question. One thing that is not open to debate is that few GOP leaders will seek to slash these entitlements that drain the federal budget of vast revenues. Yet they’ll continue to rail against expenditures on food stamps as a prime government revenue drain.

The GOP figured that waging a fierce political, media and public relations campaign against Obama’s tax hikes for the wealthy would be a can’t-miss tactic to rally conservatives, the business community and a significant number of Americans who genuinely believe government spending and power is way out of control. They also thought it could take some of the luster off of Obama’s decisive presidential win by tarring him as an autocratic, power-grabbing, tax-and-spend business and budget buster.

It hasn’t worked. Polls show that a majority of Americans favor hiking taxes on the rich and preserving entitlement programs that benefit the middle and working class, and even the poor. This won’t stop the GOP, though, from waging its age-old battle to protect the rich and batter a Democratic president on its straw man issue of no tax increases for the rich. That in itself is more than reason enough why President Obama must stand firm on taxing the wealthy.

Earl Ofari Hutchinson is an author and political analyst.