Beware fuzzy math

| “I don’t know what he’s talking about. They have been taking 7.65 percent for Social Security and Medicare from each and every one of my paychecks until Obama gave us a break.” |

Income taxation became permissible with the 16th Amendment to the U.S. Constitution in 1913. There was a major political battle then as to whether indirect taxes should be allowed. Big government was not the issue in 1913, but there was an awareness that it would be expensive to build the country’s infrastructure. There has been a political debate in the country about appropriate income tax rates ever since.

Fifty years ago the tax rates were substantially higher than today. In 1961, a married couple filing jointly would be taxed at 89 percent on income over $200,000 and 59 percent at the $50,000 bracket. The Bush tax cuts have now reduced those levels to 28 percent and 15 percent, respectively.

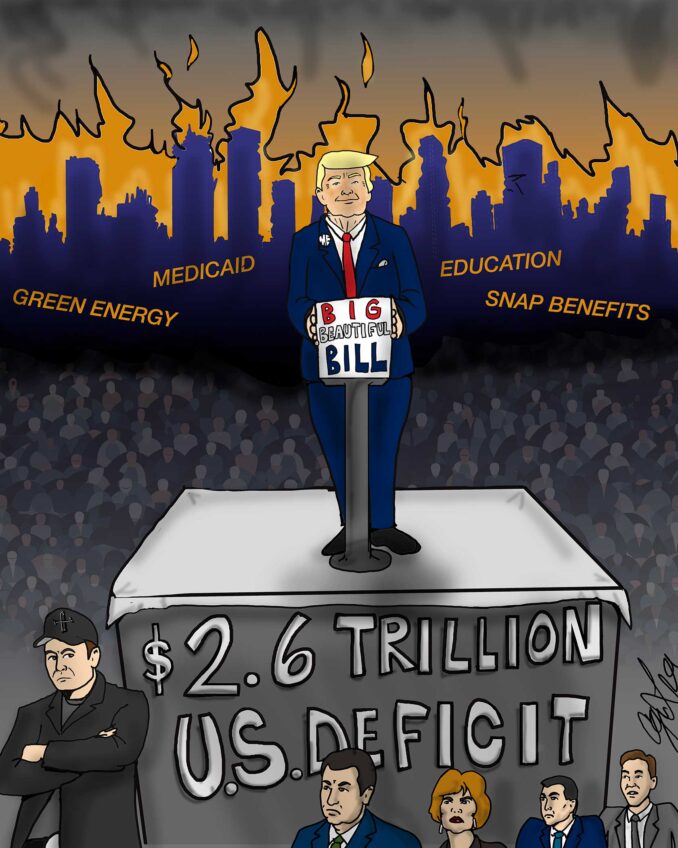

In view of the dramatic cut in income taxes over the years, the argument that the country has a spending problem rather than insufficient tax revenue is hard to accept. Indeed, government operations have to be more efficient. Ineffective programs have to be eliminated. Political patronage jobs and financially excessive earmark projects have to be controlled. However, the objective cannot be to reduce taxes no matter what.

The Republican argument that a high income tax rate reduces economic activity is not supported by the history of the growth of the nation’s gross domestic product (GDP). There has been constant growth in the slope of the GDP curve that became even steeper from 1980 when the marginal tax rate for $200,000 was 68 percent, a 40 percent higher rate than today.

In the debate over extending debt limits, conservatives asserted that the budget deficit was primarily the result of overspending. However, a review of Bush tax cuts and his policies raises questions about the accuracy of that analysis.

The Bush tax cuts from 2002-09 lost $1.812 trillion in revenue. During this period the wars in Iraq and Afghanistan and Defense Department expenses cost $1.469 trillion. Without the tax cuts, Bush would have had $34.3 billion left over for other expenses.

In the past, governments have always raised taxes to finance wars. It’s the old “guns or butter” quandary. If there is insufficient revenue to finance domestic projects as well as finance a war, there is no logical choice but to raise tax revenues. However, Bush decided to finance the war with debt.

It is important to remember that President Clinton left office with a budget surplus of $127 billion and Bush with his tax cuts contributed substantially to the country’s present financial predicament. He left a deficit of $455 billion.

It is not interesting for most people to become involved in federal tax and fiscal matters. It is simply dull. But a new danger developed of late in the debt limit debate that should hold your attention. There are some people, including members of Congress, who are willing to scuttle the ship of state if they do not get their way. This mindset is as menacing to the viability of the republic as the attitude that led to the Civil War.

Do not believe that this is just business as usual. This is a critical time for civic engagement. The battle is by no means over. The conservatives still want to end Medicare and restrict Social Security to artificially low levels, all to reduce taxes. Be passive on these issues and you will be guaranteed a very difficult old age.