Debt: A college burden

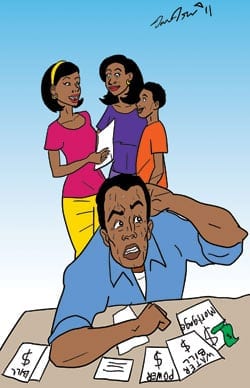

The price tag for one year at an elite college now exceeds $50,000. The median household income in the U.S. in 2008 was $52,029. Clearly, the majority of families could not afford to pay college fees from current revenue. Students from most families must depend on scholarships, grants and loans to pay college expenses.

As the cost of education has climbed, students have been forced to depend more and more on loans. According to the Federal Reserve Bank, as of June 2010, the total credit card debt in America was $826.5 billion. However, some analysts have established the student loan debt as even higher at $829.8 billion.

Six months after graduation, many graduates must face up to the process of repaying a mountain of debt. Sadly, those who have been forced to drop out before completing their course of study must also begin repayment without a certificate or degree to show.

America’s youth are being saddled with a substantial debt, and the consequences of delinquency are severe. Once a borrower is 60 to 120 days delinquent, the lender is required by law to report the fact to a national credit bureau. This adverse information can remain on the borrower’s credit report for up to seven years. This will lower the FICA score and make it more difficult for the borrower to obtain credit for other purchases. The delinquent might be unable to buy a car or acquire a credit card with reasonable terms.

The burden of repaying an onerous education debt will tend to induce a student to pursue employment with the highest salary and postpone professional preferences that pay too little to retire the debt and live comfortably. Top college graduates who might prefer public service will often look to Wall Street rather than humanitarian pursuits.

The Institute for Higher Education Policy (IHEP) published a report in March entitled “Delinquency: The Untold Story of Student Loan Borrowing.” Their objective was to provide real world data to enable analysts to evaluate the financial consequences of the way we pay for college education in America.

The study focused primarily on 1.8 million student loan borrowers who began repayment in 2005. The record indicates that repayment is a challenge. Only 37 percent of borrowers were able to service their debt in a timely manner. Another 23 percent obtained a deferment or forbearance to postpone repayment without incurring delinquency status. A total of only 60 percent of borrowers are technically current. During the first five years of repayment, 41 percent of borrowers become delinquent. Of those who become delinquent, 13.7 percent of borrowers default.

If higher education were only for the benefit of the individual student, then the cost would be merely the expense of one’s lifestyle. However, the U.S. needs a highly educated population to be competitive in the global economy. The country must at least find a better way to finance the college education of students interested in technology and other areas of special importance to the nation’s industry.

A system that saddles the young with oppressive debt is not the best approach to financing higher education. With a huge default rate of 13.7 percent, the student loan system induces the young to commit to a process that is too often financially destructive.