Consumer protection key in protecting middle-class

Before we begin I just want to mention a report that was released by the Census Bureau last month about what happened to wages during the last decade. It revealed that between 2001 and 2009, the incomes of middle-class families fell by almost 5 percent.

I want to repeat that. Between 2001 and 2009, the incomes of middle-class families fell by 5 percent.

In the words of the Wall Street Journal, this “lost decade” was the worst for families in half a century — a decade that obviously ended in a devastating recession that made things even worse.

We know that a strong middle class leads a strong economy. And that’s why, as we dig our way out of this recession, we’ve set our sights on policies that grow the middle class and provide a ladder for those who are struggling to join it.

Part of what led to the financial crisis were practices that took advantage of consumers, particularly when too many homeowners were deceived into taking out mortgages on their homes that they couldn’t afford. But we also know that these practices predated the crisis, and we also know that these practices don’t just exist in the housing market.

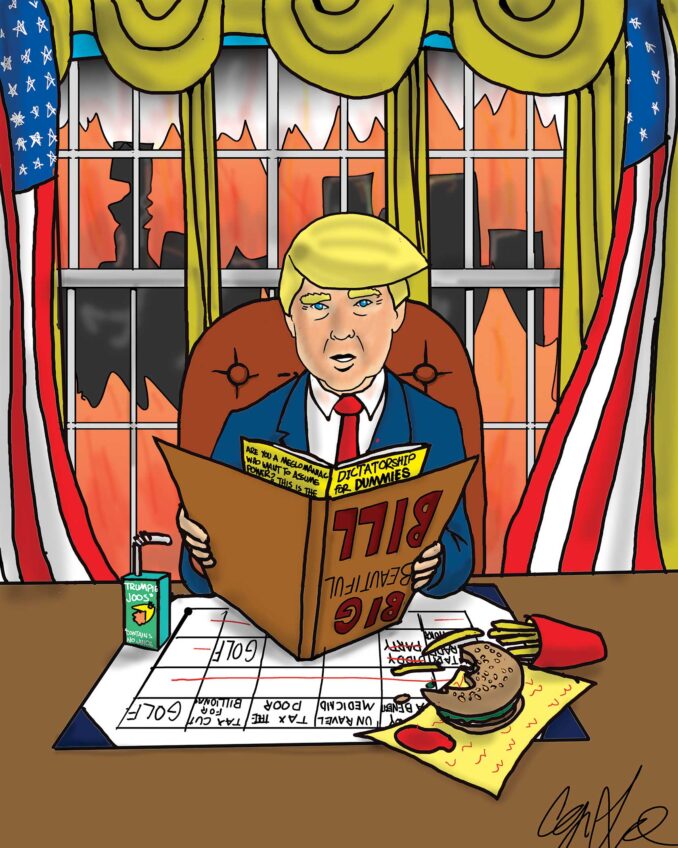

For years, banks and mortgage lenders and credit card companies have often used fine print and confusing language and attractive, front-end offers to take advantage of American consumers. We’ve seen banks charge unreasonable overdraft fees. We’ve seen credit card companies hit folks with unfair rate hikes. We’ve seen mortgage lenders offer cheap initial monthly payments and interest rates that later skyrocketed. All this has cost middle-class families billions of dollars — tens of billions of dollars — that they could have used to pay the bills or make the mortgage, or send their kids to college.

And that’s partly why even when I was still in the U.S. Senate, I took such a great interest in the work of the woman standing next to me. I have known Elizabeth Warren since law school. She’s a native of Oklahoma. She’s a janitor’s daughter who has become one of the country’s fiercest advocates for the middle class. She has seen financial struggles and foreclosures affect her own family.

Long before this crisis hit, she had written eloquently, passionately, forcefully, about the growing financial pressures on working families and the need to put in place stronger consumer protections. And three years ago she came up with an idea for a new independent agency that would have one simple overriding mission: standing up for consumers and middle-class families.

The Consumer Financial Protection Bureau, which was one of the central aspects of financial reform, will empower all Americans with the clear and concise information they need to make the best choices, the best financial decisions, for them and their families.

Never again will folks be confused or misled by the pages of barely understandable fine print that you find in agreements for credit cards or mortgages or student loans. The bureau is going to crack down on the abusive practices of unscrupulous mortgage lenders. It will reinforce the new credit card law that we passed, banning unfair rate hikes and ensure that folks aren’t unwittingly caught by overdraft fees when they sign up for a checking account. It will give students who take out college loans clear information and make sure that lenders don’t game the system.

Basically, the Consumer Financial Protection Bureau will be a watchdog for the American consumer, charged with enforcing the toughest financial protections in history.

Now, getting this agency off the ground will be an enormously important task, a task that can’t wait. And that task is something that I’ve asked Elizabeth to take on. She will help oversee all aspects of the bureau’s creation, from staff recruitment to designing policy initiatives to future decisions about the agency.

Elizabeth understands what I strongly believe — that a strong, growing economy begins with a strong and thriving middle class. And that means every American has to get a fair shake in their financial dealings.

For years financial companies have been able to spend millions of dollars on their own watchdog — lobbyists who look out for their interests and fight for their priorities. That’s their right. But from now on, consumers will also have a powerful watchdog — a tough, independent watchdog whose job it is to stand up for their financial interests, for their families’ future.

Excerpts from President Barack Obama’s recent statement on the appointment of Elizabeth Warren as head of the newly created Consumer Financial Protection Bureau.