No cause and effect

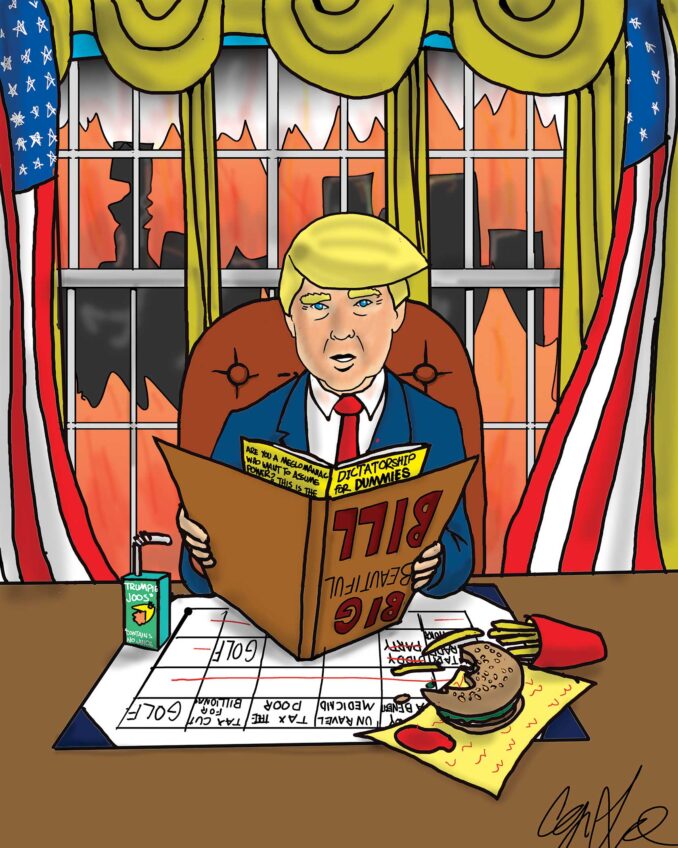

A major asset of an elected public official is a reputation for integrity and a high standard of ethics. Media reports for more than a year have implied that California Congresswoman Maxine Waters is ethically impaired. Confident of her ability to refute the charges of the House ethics committee, she has requested that they release the secret report of her alleged violation, which they have held since August 2009.

The facts are clear. Waters chairs a House Financial Services subcommittee. The federal takeover by former Treasury Secretary Henry M. Paulson of Fannie Mae and Freddie Mac adversely affected a number of minority owned banks. Robert Cooper, the president-elect of the National Bankers Association, the trade association of minority banks, asked Waters to arrange a meeting for the NBA with Paulson. As a prominent African American official she did so.

This would have been a simple constituent service except for the fact that Bob Cooper is also senior counsel for OneUnited Bank. Waters’ husband had once been a director of the bank and still owns stock. Investigators imply that this connection alone would require her to refuse the request of the leader of the 45-member NBA. Neither Waters nor a member of her staff attended the meeting.

It so happens that the meeting with Paulson was not especially beneficial to OneUnited or any minority bank. In fact, any benefit was primarily the result of the intervention by Congressman Barney Frank, chairman of the House Financial Services Committee. Frank, a congressman from Massachusetts, has a special interest in OneUnited because it is the only African American bank in his state.

The language of the $700 billion bank bailout program was amended to include small banks. Bank regulators were given the authority to approve qualifying small banks for so-called TARP funds. OneUnited was one of the NBA banks that qualified, and TARP funds were approved for the bank by the Federal Deposit Insurance Corporation. Paulson had nothing to do with the TARP grant, but that apparently was the act that created an allegedly unethical benefit to Waters’ husband.

Clearly, that is absurd. And Waters is clearly innocent of any impropriety. Would there even be an issue if no black banks had benefitted? Perhaps that change in circumstances is the underlying reason for all the furor.

CORI reform: A good first step

Gov. Deval Patrick signed into law last week a bill to reform the state’s CORI system. The Criminal Offender Records Information law had become counter productive. It unfairly hindered the ability of criminal offenders to find employment upon returning to society.

Patrick first filed CORI reform on Jan. 11, 2008. It took 31 months to work its way through the Legislature. The new law will make felony records available to potential employers for 10 years and hold misdemeanor records open for only five years, provided there are no subsequent offences. Murder and sexual offences remain permanently available.

Many employers are not excited about hiring ex-cons. With limited opportunities for employment, the rate of recidivism is high. Within three years of release from prison, 39 percent of offenders will be back in custody; for those convicted of property offences the rate is higher — 57 percent, according to Massachusetts Recidivism Study: A Closer Look at Release and Returns to Prison.

Patrick sees this newly enacted measure as a first step toward creating a corrections system that really corrects. “The best way to break the cycle of recidivism is to make it possible for people to get a job,” assured Patrick.