Banks bomb on stress tests for minority lending

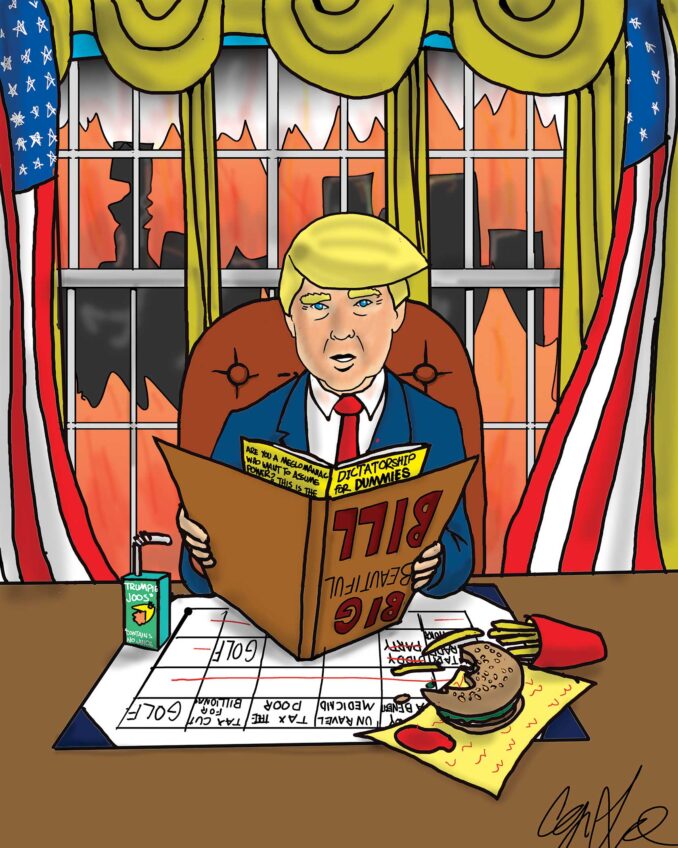

A buoyant Treasury Secretary Timothy Geithner reassured the public that the “big 19” — the 19 giant banks and financial houses that, to hear him tell it, are responsible for the fate of Western capitalism — have passed their Treasury-imposed “stress” tests.

That wasn’t hard to do, especially after taxpayers greased the skids with more than $50 billion in handouts. On top of that, the stress tests were puff-ball trials that didn’t impose tough or new government-enforced financial requirements or restrictions on the banks.

Tests aside, a slew of debates rage on. How much taxpayer cash do the banks and financial houses really need? How much more will they need on top of what they’ve already gotten? How long will they need it? Will the money really ensure permanent solvency?

And forgotten in the hubbub over the Geithner-glossed report is the painful fact that thousands of black and Latino homeowners are still left holding the financial bag for the subprime mortgage mess.

Fair Finance Watch and the Center for Public Integrity both issued reports on mortgage lending practices on the eve of the Geithner bank stress tests. The reports revealed that from 2005 to 2007, the 19 bailed-out banks and financial houses went nearly $1 trillion into debt with taxpayers.

The banks ran up that debt through holding companies, investment houses, financial and real estate subsidiaries, and through stock purchases and sales. But the bulk of it came through toxic subprime loans to mostly minority homebuyers.

The reports also showed that the subprime loans did little to help revitalize grossly underserved minority communities. In fact, Bank of America — which is holding its hands out for another $34 billion in taxpayer funds — had one of the lousiest records in lending to minorities, and the loans that it did make were far more costly than those it made to whites.

But Bank of America was hardly the sole bad actor. The top bank welfare recipients raked in tens of billions in profits and taxpayer handouts while engaging in Scrooge-like lending policies. When they did lend, they charged rates that would make loan sharks blush.

Wells Fargo charged African Americans more than twice as much as whites for home loans. JPMorgan charged both African Americans and Latinos more than twice the rate of whites. Citigroup, U.S. Bancorp and Wachovia charged minorities one and a half times more.

On top of that, blacks and Latinos were more than one and a half times more likely than whites to be denied loans by the top banks receiving taxpayer bailout cash. And income wasn’t a major consideration for the lenders who were pitching subprime loans — the prime determinants in deciding whom to target were race and the neighborhoods where they lived. A study conducted by the U.S. Department of Housing and Urban Development found that upper-income blacks were one and a half times as likely to have a subprime loan as persons that lived in low-income white neighborhoods.

At times, subprime lending took on elements of loan racketeering, and it’s a racket that hurt — and still hurts — tens of thousands of would-be black and Latino homeowners. The lenders’ bait-and-switch tactics, deliberately garbled contracts, hidden fees, deceptive lending and questionable accounting practices — all of which took place under the sleepy-eyed, see-no-evil oversight of federal regulators — are well-documented. Their snake-oil peddling wreaked havoc on thousands of mostly poor homeowners.

The recent reports on the top banks’ lending practices make clear that they continued to rake in big profits even as they padded their bottom lines with taxpayer dollars. The banks and holding companies can suffer huge losses from their subprime loans but still make money, and lots of it. HSBC Holding, for instance, reported losses of $10 billion from bad loans in 2007, but still reported a 5 percent rise in its profits.

Subprime lending was highly profitable for a brief time, and was not a crushing risk for the banks when the loans went sour. They offset their losses through tax write-offs, increased service fees, lower saver interest rates, and stock sales and swaps. They had one more trump card to cleanse their toxic debt — the taxpayer’s pocketbook — and they have played that card magnificently.

The great flaw in all this is that banks are still largely left alone to police themselves. They determine how much, and to whom, they’ll lend. They will continue to make loans to minority homebuyers, as they are required to do under the terms of the much-maligned Community Reinvestment Act, and many of those borrowers will continue to pay dearly for those loans. That’s a stress test that the banks won’t have to take, let alone pass.

Earl Ofari Hutchinson is a syndicated columnist, author and political analyst. His weekly radio show, “The Hutchinson Report,” can be heard in Los Angeles on KTYM 1460 AM and online at http://www.blogtalkradio.com.