Clear policy differences

|

|

“You know, I used to believe in the American dream.” |

Many Americans are facing a financial crisis. Some have lost their homes through mortgage foreclosure. Others are in bankruptcy because of costs resulting from a major illness not covered by their health insurance, or have seen the value of their retirement nest egg shrink in the Wall Street collapse.

And many have lost their jobs as employers scale back their operations amid the financial market’s uncertainty. People are now trying to understand the complexities of the economic system that brought the nation to this point.

As one might expect, Democrats and Republicans disagree on both the cause of the crisis and the most appropriate solution. Republicans tend to protest against big government, favoring rugged individualism and an unfettered free market, while Democrats support public finance of programs to fund solutions to social ills.

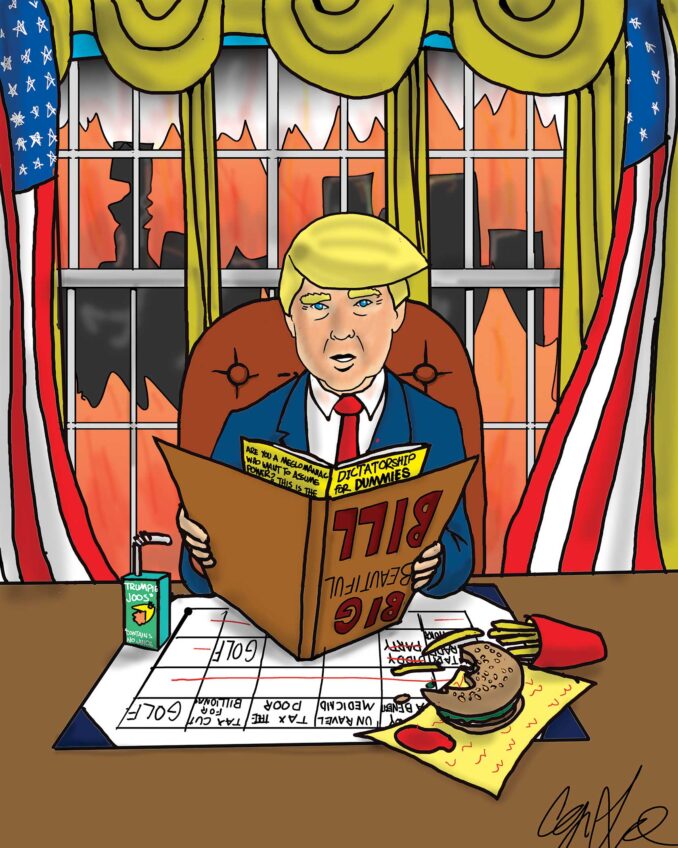

Sens. Barack Obama and John McCain differ substantially on tax policy. Obama wants tax cuts for the middle class, while the McCain tax cuts would primarily benefit the affluent. For example, a taxpayer with an income of $66,400 would save $1,118 under the Obama plan, but only $325 under the McCain system, according to the nonpartisan Tax Policy Center. However, a person with an income of $1 million would pay as much as $94,000 more under Obama but would save about $48,000 under the McCain system.

Republicans have fiercely opposed a progressive tax system that requires those with higher incomes to pay taxes at a higher rate. This is a governmental implementation of the Judeo-Christian ideal to be your brother’s keeper. Republicans support lower taxes, because a financially starved government must necessarily be small.

McCain’s health plan would also have disastrous consequences for the individual and would benefit health insurance companies. Under the current system, most Americans participate in health plans at work. Large employers have the economic strength to negotiate favorable policies for their employees. The fact that these costs are tax-deductible gives employers an incentive to be involved, and the result is less expensive coverage for employees.

The McCain plan would give the insured a $5,000 tax credit, but applicants would have to enter the insurance market alone, rather than as members of a group, substantially reducing their bargaining power. In addition, insurers would not have to accept those with pre-existing conditions, and applicants would no longer be protected by the regulations of their home states since policies could be sold nationwide.

The aversion to market regulation seems to be part of the Republican creed. McCain wants to bring to health insurance the same sort of chaos that President George W. Bush brought to Wall Street. Unregulated hedge funds and investment banks used too much leverage to buy mortgage-backed securities and were unable to cover the cost when their values declined.

Ironically, Republicans who support small government turned to taxpayers’ funds to avert a deep depression after the market plunged. But they also wanted to stick the public with the cost of the losses while the captains of finance kept all of the profits for themselves. The rationale for such a one-sided proposal was that it was a necessary measure to prevent socialism.

The American dream is still very much alive, but working- and middle-class Americans need a president like Barack Obama to protect their interests.