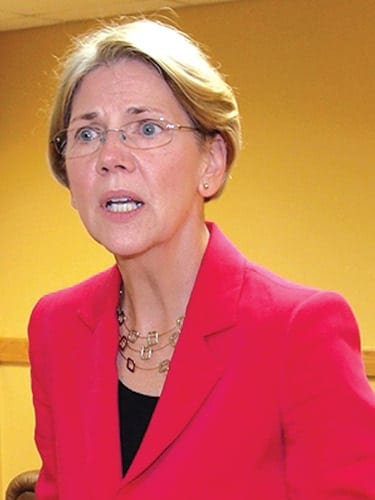

Elizabeth Warren knows what education can do. Her new book, “A Fighting Chance,” tells of what it did for her — starting at age 16, when she secretly applied to college and persuaded her parents to let her go. After earning both a bachelor’s and a law degree, she immersed herself in bankruptcy law, which taught her how easily ordinary people can spiral into debt. Here, the Democratic U.S. senator from Massachusetts tells ProPublica why she’s decided to tackle the problem of student-loan debt, and what the government can — and should — do to help.

Why have you taken on the issue of student debt?

The cost of college has gone through the roof. More and more young people have to finance through bigger and bigger student loans. They leave school and they’re trying to start a life, start a family, get a job — and they’re drowning in debt.

I want every person to have the kinds of opportunities I had. It’s personal. My parents struggled financially. My father ended up as a maintenance man, and my mother worked the phones at Sears. Education opened a thousand doors for me. I had loans, and I worked part-time, and it was enough to keep me going. But the big difference is that I went to school at a time when this country was investing in students.

How big a problem are we talking about?

There’s $1.2 trillion outstanding in student loan debt. That’s more than credit card or car loans, more than any other kind of consumer debt except mortgages. It’s crushing people.

It also has the highest delinquency rate of all types of consumer debt.

That’s right. Because students can’t manage debt loads this size, particularly in a sluggish economy.

Why should people care about this issue?

Student loan debt affects the whole economy. Instead of buying a house or a car, young people are pinching pennies to deal with crushing amounts of debt. That’s not good for the economy. It’s not good for businesses. We need those young people entering the workforce and able to spend.

What is Congress doing to help?

This is the part that makes me grind my teeth. Right now, the United States government is making huge profits off the backs of our students. Our young people not only have to pay back the cost of the loans, they have to pay billions more in interest to the government — like an extra tax for trying to get an education. That’s just wrong. We ought to be investing in young people who are trying to get an education — not making it harder for them.

Student loans are treated differently than many other kinds of debt under bankruptcy law, so it’s much harder for struggling borrowers to discharge their student loans. Do you think this should be changed?

Yes. I have co-sponsored a bill with Sen. Durbin, D-Ill., that called for making student loans dischargeable in bankruptcy. Keep in mind: Young people who have student loan debt — they didn’t go to the mall and charge up a bunch of things they couldn’t afford — but if they had gone to the mall, they could discharge those debts in bankruptcy. It’s only the student loan debt they can’t discharge.

So what should the government be doing?

For both private loans and federal loans, the fixes are pretty similar. We need to restore bankruptcy protections, provide better oversight of the government contractors that work with borrowers and process loan payments, and ensure that struggling borrowers can get help to modify their loans.

About those private contractors handling student loans, how could the Education Department be providing better oversight?

The first step here is transparency. There’s not much information about how student loans are performing or how the loan servicers are working with borrowers to help them repay their debt. The Department of Education should collect better information and make it public.

The student-loan system is complex. What advice do you have people at different parts of the process?

For the person who hasn’t taken on any student loans yet, someone who’s looking at college: First, fill out the federal financial aid form. It’s online and it’s free. Students who don’t fill out the form miss out, not just on federal grants and loans, but also on scholarships from their colleges and from their state. Fill out the form. It’s really important.

What about for people who are further along, and behind on their loans or teetering on that financial edge?

Find out about the help that’s available. The federal government has several repayment programs that can cut a borrower’s payment to a percentage of income, but it’s not as easy as it should be to enroll in these plans. People have to search online to learn about the programs and call their servicers to ask about them. For some people, this will provide real help.

The cost of college is a huge, underlying part of this student debt conversation. How do we meaningfully attack the cost problem?

One of the ways we can do that is to make sure that colleges have skin in the game for getting their students educated and able to repay any money they borrow. It’s going to take everyone working hard on this: the colleges, the government, and the students. We’ve all got to push in the same direction on bringing down the cost of school.

I’ll say one more thing. Three out of every four students today is in a public university. When I was growing up, the states invested in public universities to keep the costs low for students. Today, the states make much smaller investments than they made a generation ago. That means our students and their families have to pick up the costs. We need to make those investments in education so that all of our kids have a low-cost option for a high-quality education.

What are the odds that in this political climate Congress can get something done?

You can’t get what you don’t fight for. We make change when we get noisy and insist that Congress follow through. There’s so much at stake. Fixing the student-loan problem is about building a strong future for our country. That’s where I’m focused and that’s where I’m going to stay focused.

ProPublica

This story was co-published with Marie Claire.