Do your homework before buying a condo

Expert urges buyers to assess health of condo association

Looking to buy a single-family home in Roxbury? Prices range from $365,000 for a short-sale to $2.9 million for a Highland Park estate.

The real estate website Zillow lists the median sale price for single-family homes in the Roxbury ZIP code 02119 at $435,000. The median sale price for a Roxbury condominium, however, is substantially lower, at $380,000. In the Grove Hall ZIP code 02121, which includes parts of Roxbury and Dorchester, a Zillow search shows the median sales price for condominiums at $321,000.

While price is a major incentive — perhaps mores than any other factor — the supply of single-family homes is driving interest in condos, says real estate broker Kobe Evans.

“We don’t have a great supply of single-family homes,” he said. “There are a lot more options with condos.”

Hemmed in by the ocean and by surrounding cities and towns like Cambridge, Brookline, Quincy and Chelsea, Boston doesn’t have much in the way of vacant, developable land. And as city officials struggle to encourage the production of new housing units to meet growing demand from the city’s expanding population, apartments and condominiums make better sense for developers and yield higher profits.

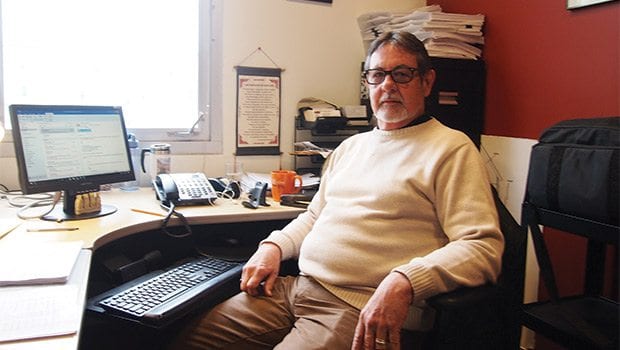

But prospective buyers must do their homework before snapping up a deal in Boston’s condominium market, warns Jorge Casas, the HomeSafe program manager at the Massachusetts Affordable Housing Alliance.

“It’s like buying a business,” Casas says. “You have to scrutinize the condo association and find out how they’re running.”

Some buyers prefer a condominium to home ownership because of the ease of maintenance. With a condominium, owners are responsible for repairs to their own dwellings — everything on the inside of the unit they own, as well as the unit’s individual heating and electrical systems. Through a condominium association, all the owners in the building share the expenses of maintaining the common areas — the front entryway, stairs and hallways — as well as the exterior of the building, the front and back yards and driveway.

In many larger condominium associations, each member owner shares in the expenses and decision-making while a management company secures contractors for maintenance and repairs. In smaller condominium associations, individual owners often have to negotiate cleaning, maintenance and repairs with each other.

“You don’t have to be friends with the other association members, but you have to be in a relationship with them,” Casas says. “In smaller associations, those with fewer than 10 units, they often don’t have the money to pay for a property manager and end up doing everything themselves. That’s where issues can arise.”

In these smaller condominium associations, the financial well-being of each member is vital to the well-being of the association as a whole. Monthly condo fees pay for the day-to-day maintenance and insurance on a condo building, but when major repairs such as roof replacements are needed, members must agree to pay a special assessment for the work. Condominium associations typically vote on what repairs will be made and when. If an association member cannot pay his or her monthly condo fee, the burden of monthly maintenance falls on the other members. If an association member cannot afford an assessment, needed repairs may not get done.

Casas advises prospective buyers to ask their real estate brokers to investigate the condo association before deciding to go forward with a purchase.

Among the questions to weigh when considering buying a condominium, according to Casas:

- Are the condominium association’s finances in the black?

- Are all members keeping up with their monthly condo fees?

- Are there any major repairs needed to the building?

- What type of insurance does the association carry?

- What are the monthly condominium association fees?

- Are members in compliance with the association’s rules?

In associations with more than 10 members that have well-functioning management companies, condo ownership can be easier than owning a house. And with housing prices continuing to rise in Boston, condos are becoming increasingly popular.

“It seems to be the only option for many people who want to buy in the city,” Casas says.

And approaching the process with a little caution can make the difference between a satisfying purchase and a regrettable one.

![Banner [Virtual] Art Gallery](https://baystatebanner.com/wp-content/uploads/2024/04/Cagen-Luse_Men-at-store-e1713991226112-150x150.jpg)