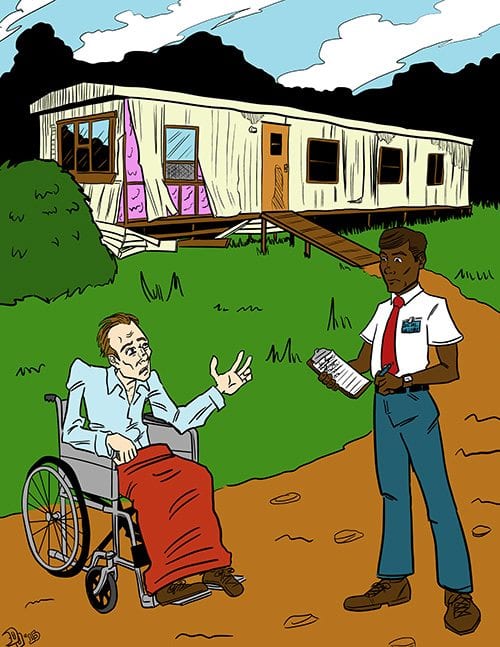

Last month the nation celebrated the 25th anniversary of the Americans with Disabilities Act. That is the statute that provides civil rights for those who are impaired. Also, landlords and builders were required to provide wheelchair access to buildings. Most important of all is the disability insurance benefits provided by the Social Security system. But projections are that those payments will have to be cut next year.

Workers who pay into Social Security provide the funds to be distributed through the Disability Insurance fund. According to fund trustees, payments will have to be reduced by 19 percent in 2016 because of insufficient payments into the system by workers. The other aspect of Social Security, the retirement fund, also is often threatened with imminent depletion. One problem is that the rate of return on investments is too low.

The law requires Social Security to invest funds received only in special government debt instruments. The average rate of interest received in 2014 was only 2.271 percent. That is all Social Security was permitted to earn while other financial institutions such as hedge funds and equity funds racked up substantial profits. It has been suggested that a portion of the Social Security funds should be allowed to be invested more aggressively.

Conservative opposition to Social Security prevents reasonable improvements in the system. Social Security to them is the odious essence of “big government” that even interferes in personal financial planning for retirement. And most threatening of all, conservatives fear it would be a giant step toward socialism to permit a government agency to buy securities in the open market.

Nonetheless, the problem with Social Security is not going away.

A major issue is that Americans are living longer. In 1940 the average longevity was only 62.9 years. That was hardly old enough to qualify for retirement. By 2012 the longevity age had increased to 78.8 years, a substantial difference. Either greater investment or tax revenue will be needed to maintain the level of benefits.

Even the conservatively invested Harvard University endowment delivered a 15.4 percent return for 2014. That is 13.13 percent more than the rate of return for the Social Security investments in 2014. With $1,084 billion invested by the trustees during 2014, the increased revenue at a higher rate would have been substantial.

When he was president, Bill Clinton proposed that a portion of Social Security funds be invested in foreign securities. He thought that would allay any concern about the government owning the American means of production. But the idea fell flat. Not only do conservatives fear socialism, they also have no greater interest in improving Social Security than in improving the Affordable Care Act (Obamacare).

More liberal American voters do not understand some of these sophisticated issues well enough to be effective political opponents of the conservatives. For instance, conservatives insist that the Export-Import Bank provides corporate welfare for large companies. The fact is that the EXIM Bank was organized 81 years ago to facilitate foreign trade. Congress has extended its charter 16 times. Rather than cost the taxpayer money, the EXIM Bank actually earned a surplus of $675 million in 2014. Corporate welfare claims are false. The bank’s charter should be extended.

While private enterprise is the foundation of the American economy, it is nonetheless accurate to assert that the economy is mixed because of the commitment of the government to solve problems that arise. For example, during the recent bank crisis the government established the $700 billion Troubled Asset Relief Program (TARP) in October 2008 to save the banking system. TARP was ended in December 2014 with a surplus for taxpayers of $15.3 billion.

It makes no sense to cause Americans to suffer, or even to be inconvenienced, by the adherence to a doctrine that has been so modified by collaborative public policy.