In what was described as “gross, severe financial mismanagement,” the historic Charles Street AME Church filed for bankruptcy last week, pleading to a federal judge to restructure about $4 million in debt to OneUnited bank as well as other creditors.

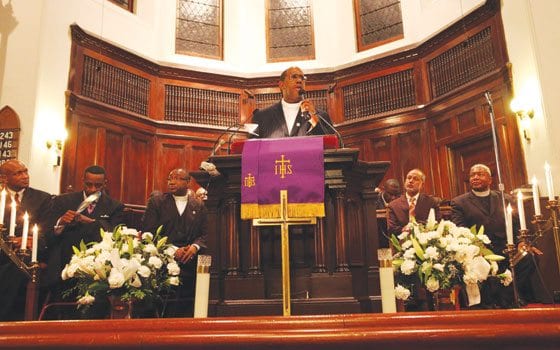

Though Rev. Gregory Groover Sr. repeatedly said in several public appearances that the church didn’t miss a payment, a different story emerged in bankruptcy court: the church was late on 43 of its 56 payments and missed its final two payments.

In addition to OneUnited, Charles Street owes about $630,000 to Thomas Construction Company, the Dorchester firm hired to build its proposed Roxbury Renaissance Center; another $450,000 is owed to Tremont Credit Union for a loan to repair the church’s roof; and an unspecified amount is owed to “no more than 20” other creditors.

The bankruptcy filings last week was a move to forestall the pending foreclosure of its property by OneUnited bank – and keep the church operating as it has for the last nearly two centuries. That includes a payment arrangement with several utility companies to keep heat, electricity and telephones turned on and the ability to pay about $45,000 a month for salaries and benefits to five full-time staff members and several part-timers.

In recent weeks, the financial dealings of Charles Street AME became the subject of a nasty public fight between two of Boston’s leading black institutions. OneUnited is the nation’s largest black-owned bank and their move to collect Charles Street’s outstanding debt triggered angry criticisms from several local politicians and black clergy.

Making matters worse was Charles Street’s charges in legal documents that said the bank made “a reckless” loan and that they knew —or should have known — that the church would be unable to repay as originally agreed.

“The loan was improperly underwritten from the start,” a church lawyer argued in court papers, “and was offered by OneUnited for the ulterior motive of expanding its retail business and gaining publicity, rather than loan made to prudent lending standards.”

During last week’s hearing before bankruptcy Judge Frank Bailey, OneUnited attorney Liam Vesely called such church criticisms “unfair” and explained that the default on the loans was not the fault of OneUnited but rather “gross severe financial mismanagement” on the part of Charles Street.

The relationship between OneUnited and Charles St. didn’t start out acrimoniously. On Oct. 3, 2006, Groover, who is also the Boston School Committee chairman, agreed to borrow $3.6 million to build a 22,000-square-foot community center on church-owned land near Grove Hall featuring a grand ballroom, multi-purpose meeting space, conference rooms, prayer and meditation space and sound proof musical practice rooms.

That loan became due on June 1, 2008, and despite a total of five extensions, the church was unable to satisfy its debt by Sept. 1, 2009. A year later, on Aug. 17, 2010, OneUnited then sued in Suffolk Superior Court for breach of contract. Also named in the suit was Charles Street AME’s co-signer, the First Episcopal District of the African Methodist Episcopal Church based in Philadelphia.

Charles Street had also borrowed another $1.1 million, separate from the $3.6 million construction loan. That loan is also in default.

And the community center remains unfinished. According to Thomas Construction, Charles Street agreed to pay $2.9 million to build the center. Charles Street further agreed on nearly $550,000 in extra work. Charles Street paid the firm about $2.5 million but failed to pay the remaining balance of about $630,000.

Judge Bailey set another hearing on May 1.

The construction firm has sued Charles Street for breach of contract and also named OneUnited as a co-defendant.

Vesely, the OneUnited attorney, told Judge Bailey during the hearing that the bank’s goal was not to put Charles Street AME out of business. “I want to make it clear that the bank is not trying to put this very honorable and good church out of business,” Vesely said. “But the bank is a lender that also has its own mission.”