The safety net under siege

There is a human proclivity to restrict all memory of unpleasant and painful experiences to the far reaches of the mind. That is the way people cope with the major adversities that beset our lives. Unfortunately, this forgetfulness induces people to ignore serious problems before they are resolved.

For example, how many really remember the anguish of last summer as Congress wrangled over extending the nation’s debt limit? Many people feared that failure would create an international financial crisis. The threatened bankruptcy was averted with the creation of a bi-partisan congressional supercommittee that was required to propose budget reductions by Thanksgiving.

The supercommittee has failed. Now there will be an automatic spending cut of $1.2 trillion that will become effective in 2013. For the most part, citizens are indifferent to the failure of the supercommittee process. One reason might be that the defense budget will suffer a major share of those cuts. Many voters would support that. It could also be that the process is just too complex to hold the public’s attention.

America is now in the midst of a philosophical debate as significant as the one that lead to the Civil War. As a nation, we must decide what services and assistance we owe to our fellow citizens. Implicit in that question is what is a fair tax rate to finance those entitlements.

With the 99 percenters protesting across the country, their assertion is that the top 1 percent of taxpayers do not pay their fair share of taxes to support those benefits. However, conservatives insist that it is inherently unfair for the wealthy to be taxed at a higher rate just because they have earned more money. They also assert that the higher tax rates are also counter productive because they penalize and discourage those citizens who are most likely to create jobs.

There are also some issues on which both sides agree: The tax code is needlessly complex, some taxpayers unfairly benefit from special tax benefits, some federal programs are inefficiently managed, government programs that do not provide the anticipated benefits should be curtailed or eliminated, and Medicare must be modified to provide the health benefits in a more financially economic manner.

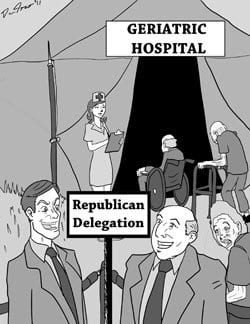

Unfortunately, the conservative obsession with tax cuts has retarded progress on achieving the necessary improvements in federal programs. For example, Congressman Paul Ryan’s proposal to reform Medicare included tax cuts that would reduce revenues, according to estimates, by as much as the savings in the cost of Medicare. This creates the impression that the major concern is tax cuts.

Despite the conservative obsession, taxes for the wealthy are not at an all time high. In 1961, 50 years ago, a married couple paid taxes of 89 percent on income above $200,000 and 59 percent of income of $50,000. By comparison, the top tax today is only 35 percent and 25 percent for incomes of $50,000.

Even with the higher tax rates, there was continued growth in the country’s GNP. This is contrary to the conservative assertion that higher personal taxes oppress productivity. Nonetheless, this fallacy has been given substantial publicity.

The affluent will continue to pursue their interests aggressively. The people have to stay informed and involved if they are to have any chance at winning the battle.

![Banner [Virtual] Art Gallery](https://baystatebanner.com/wp-content/uploads/2024/04/Cagen-Luse_Men-at-store-e1713991226112-150x150.jpg)