Rich versus poor

Class warfare has erupted in America. Many citizens still do not hear the roar of the cannons because the conflict has been disguised as merely a battle over how to reduce the federal budget deficit.

In the recent fiscal year the federal deficit was $1.3 trillion. The government had to borrow 37 cents of every dollar it spent because of the shortfall in tax revenues. This deficit is clearly unsustainable. The solution is to cut the budget, increase taxes, or adopt a combination of the two.

The problem is exacerbated by the fact that the nation is recovering from the worst recession since the 1930s. More than 15 million Americans are out of work. Joblessness has extended for more than six months for 6.3 million of the unemployed.

Unemployment is a personal tragedy for those families that have to struggle to survive without income, but it also depresses the economy even further. Payroll taxes to pay the expenses of government become diminished, and there is a decline in personal consumption that provides two thirds of the economic engine to fire up the economy.

Liberals want to commit $50 billion for unemployment benefits for 2011. When compared with the $700 billion to bail out Wall Street, that is relatively modest, especially since the total amount might not be needed as the economy improves.

Nonetheless, conservatives object to the extension of unemployment benefits as an unreasonable expenditure. However, they seem willing to modify this position if the Bush tax cuts are extended to include the wealthiest Americans. President Obama wants to extend the tax cuts, which will expire on Dec. 31, only for the first $250,000 of income. The wealthiest 2 to 3 percent of Americans would then be taxed at the higher rate in effect during President Bill Clinton’s administration.

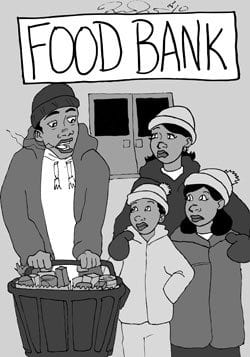

The cost of the tax cuts for the rich would be more than enough to finance an extension of unemployment benefits. However, the rich want to hold unemployment benefits for millions of unfortunate Americans hostage to their continued tax cut. This issue is especially significant for African Americans, who suffer from a very high rate of unemployment. As of November, 16 percent of blacks were out of work compared with 8.9 percent of whites.

For decades the rich have opposed income taxes as too high, and they have been especially opposed to a graduated system that taxes higher incomes at a greater rate. Over the years they have been quietly winning this battle. In 1955 the highest income tax rate was 91 percent. The highest rate now is 35 percent, a difference of 56 percent. The report of President Obama’s debt commission does not propose raising that rate. If the Bush tax cuts for the rich are not extended, the highest income tax rate would rise to only 39.6 percent.

The rich in the U.S. have considerable wealth to secure. According to the Organization for Economic Cooperation and Development, the U.S. has the most inequitable distribution of income of all the industrialized nations. Now an estimated 28 percent of the total net wealth is owned by the richest 2 percent of families. Some members of this group are unwilling to pay higher taxes to finance unemployment benefits for those suffering because of the economic collapse.

Their next target will be to reduce the scope of the safety net for citizens. Special targets are Social Security and Medicare. The only way that the rich can reduce the tax rate is to diminish the fiscal costs of running the government. So they go after the programs that they don’t need, the ones that benefit the poor.

The war is on. Citizens of modest means must enter the fray or the battle for greater equality will be lost.