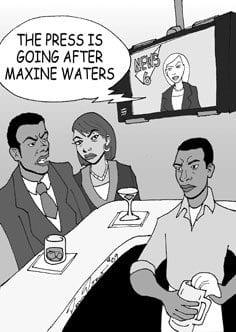

A warped media perspective

With the nation’s banking system still in crisis, the media have the heavy responsibility of reporting conditions without unduly causing a greater lack of public confidence. Unfortunately, the press failed in this obligation with recent stories about OneUnited Bank.

It appears that the media objective was to expose an assumed impropriety of U.S. Rep. Maxine Waters, D-Calif., who arranged for meetings with officials from the U.S. Department of the Treasury to discuss the impact of the financial crisis on black banks. Journalists asserted that since Waters once owned stock in black banks and her husband still did, her involvement in the survival of the minority banking system was inappropriate.

On its face, that is an absurd proposition. Waters, a member of the House Financial Services Committee, arranged the meeting in response to a letter from the chairman-elect of the National Bankers Association (NBA), a Washington-based trade association of minority banks. The purpose of the September 2008 meeting was to urge then-Treasury Secretary Henry M. Paulson Jr. to implement a plan to compensate minority banks that had been damaged by the government seizures of Fannie Mae and Freddie Mac.

In their incessant quest for scandal, real or imagined, the press seemed to believe that they had hit the mother lode because of the confluence of innocent circumstances. NBA Chairman-elect Robert Cooper is also the senior counsel of OneUnited Bank. Waters’ husband, Sidney Williams, owns stock in OneUnited Bank, and OneUnited Chairman and CEO Kevin Cohee attended the meeting at Treasury.

The journalistic appetite for scandal was whetted by the fact that the press did not know Waters’ involvement had been requested by the NBA. When they became aware of the NBA letter, the press realized that the element of impropriety would go up in smoke. Not to be denied their exposé, the press then began to pursue the question of whether Cooper had the authority to send such a request to Waters on NBA stationery.

There seems to have been little journalistic interest in whether the meetings with Treasury had been productive and helpful to minority banks. In fact, as a result of a subsequent meeting in December, a number of minority banks were able to secure Troubled Assets Relief Program (TARP) funds. However, in their quest for headlines, reporters turned to Michael Grant, the NBA’s newly appointed president, who assumed that office in September. His uncertainty about Cooper’s authorization to use NBA stationery fed the journalistic beast.

The NBA’s early action assured that qualified minority banks would participate in the $700 billion fund to restore banks’ solvency. In order for a bank to receive TARP funds, the bank’s primary regulator, such as the Federal Deposit Insurance Corporation, had to certify that the bank is sound. Along with other black banks, OneUnited qualified, and continues to operate profitably. OneUnited Bank is a major financial resource for Boston’s minority community, as well as for communities in Miami and Los Angeles, where the bank also has offices.

In 2007, even before the current recession, the unemployment rate for blacks in Boston was 12.9 percent, 2.8 times the rate for whites (4.6 percent), according to Census data. Nationally, there is a racial disparity in wealth. The average net worth of whites is $70,000 compared to only $6,000 for blacks, according to the NAACP’s 2006 “African Americans: The State of the Disparity” report, meaning that the net worth of blacks is only 8.6 percent of whites. These are the problems that OneUnited and other minority banks work hard every day to ameliorate.

In explaining her family’s investment in black banks, Waters is reported to have said, “The test of your commitment to economic expansion and development and support for business is whether or not you put your money where your mouth is.” Unfortunately, the major media seem not to understand this sound philosophy. They prefer chasing an exposé to shedding light on effective social policy.

EDITOR’S NOTE: Bay State Banner Publisher and Editor Melvin B. Miller is a director of OneUnited Bank.