Shoring up the safety net

No one knows for certain whether the $787 billion stimulus package will halt the recession. How could they? No one in authority came forward to curb the excesses that contributed to the economic ruin, even though the danger signs were prevalent.

President Bill Clinton left office with a $230 billion budget surplus in 2000. George W. Bush left office eight years later with a deficit of $410 billion. The past eight years have been marked by excesses. Consumers used the equity value in their homes like an ATM card, and savings went negative. A housing bubble inflated by subprime loans quickened the collapse. Wall Street sold mortgage-backed securities of questionable value and a bevy of arcane derivatives. This led to the failure of the banking system. The subsequent unavailability of credit forced businesses to contract and lay off employees.

There were few voices loud or persuasive enough to stop the madness. Now there are some who oppose the stimulus package because it fails to provide enough of a benefit to the private-sector financiers and industrialists who are primarily responsible for creating today’s dire economic circumstances. Conservative economists have asserted that the New Deal programs were ineffective, and the Obama stimulus plan will also fail.

The critics seem to forget that in 1930, the federal government did not see it as the responsibility of Washington to care for the indigent. Major cities maintained public hospitals for the poor. Charitable organizations provided food and clothing for the poverty-stricken. Even the care of children was a private matter for their parents that was enforced by the courts.

Then, President Franklin D. Roosevelt established the New Deal, a major revision of the social contract between government and Americans. The old thinking was that it is inappropriate for the federal government to become involved in personal financial crises. At the time, the primary responsibility of the federal government was to provide for the national defense, oversee international trade and to manage the currency as well as fiscal obligations.

Roosevelt established a number of relief agencies that still exist today. Most prominent is Social Security, which provides income for retired workers. Just as important is the Federal Deposit Insurance Corporation, which guarantees deposits in member banks so that small depositors will not lose all of their money in the event of a bank failure.

Later programs over the years established that the federal government has the responsibility to provide a safety net for American citizens. For example, Medicaid is a form of health insurance for the extremely poor. The U.S. Department of Education establishes minimum public education standards for the states to follow, and Pell Grants provide some public assistance with college expenses.

Now, 75 years after the launch of the New Deal, Americans have become accustomed to a new relationship with their government. You cannot unring the bell. The abrupt deprivation of the safety nets will create a negative attitude among the people at a time when public optimism and confidence are necessary to help pull the nation out of this recession.

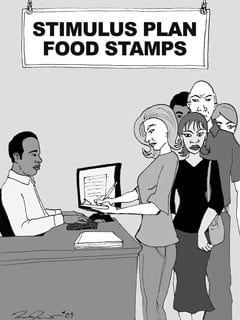

Tax cuts for the working poor, aid to the unemployed and educational assistance are just as important as infrastructure jobs to help turn the economy around. President Barack Obama clearly understands the importance of avoiding a national sense of despair.